Hello MarketShalians, Are the shocks of the capital market making you strong or breaking your back? Well, no one likes the fall of their financial portfolio, even if it is a notional loss, so what! This week there was no place to hide one’s head even in different asset classes. Equity, Gold, Silver, Crypto witnessed terrible falls everywhere. A strange situation has prevailed in the markets across the world, Bond yields are falling and stock markets are also falling, isn’t strange? If we talk about the Indian markets, although they were already falling and now they are not showing strength despite the fall of VIX, isn’t strange? Dollar index has again started gaining strength and giving pain to the emerging markets like India.

Hold on… You will say what do you want to say brother? Then in simple words I want to say that the markets are falling and it would be better if you or I do not try to find any logic in it. Many things are going on simultaneously. Trump Tariff War has not only shocked the markets of the whole world but also the U.S. markets are facing so much volatility. So Mr. Trump, whom are you benefiting? He has announced another 10 percent Tariff on China, but as I had mentioned in last week’s blog, it is possible that the Dragon has woken up after a long sleep and this could be the beginning of a new bull run in the Chinese market, although this week a period of decline was witnessed there too. It is not enough from the Trump, he is well prepared to impose retaliatory tariff on rest of the countries from the month of April’2025, so stay prepared to absorv upcoming shocks as well.

World markets are going through a very turbulent phase and in such a situation you need to relax. I try to explain one thing each time in different ways, do not create a position by taking leverage and you need to learn to sit holding your investing postions with the right asset allocation because storms are temporary and they pass, you just have to save your existence till then and then the world of wealth creation will be yours.

The market cap of INR 37.60 lakh crore in Indian markets has eroded this month. Bitcoin is trading below $80,000.00, Gold which is considered a safe heaven investment asset class is also moving towards $2800 from its lifetime highs. So are all these bad ways of investing, or is it just a phase which you have to handle using your investing ability? Because even bitter things like this have happened in the past and will continue to happen and at the same time people have created wealth in the past by coming out of such phases and will continue to do so in the future as well. Nothing will be changed; you just need to ensure to stay in the game of investing.

So let us see how different asset classes performed on the trading table and what is the probability of happening next?

Table of Contents

Important Updates

Trum vs Zelensky

There was a huge argument to be seen between Trump and Zelensky in the White House, which was undesirable. Trump shouted “Either make a deal or we’re out. You’re in big trouble. You’re not going to win this” Zelensky responded in the same way: “We are in our country, and we have stood strong and will stand strong in these bad times. It may have a huge impact on the world’s geography.

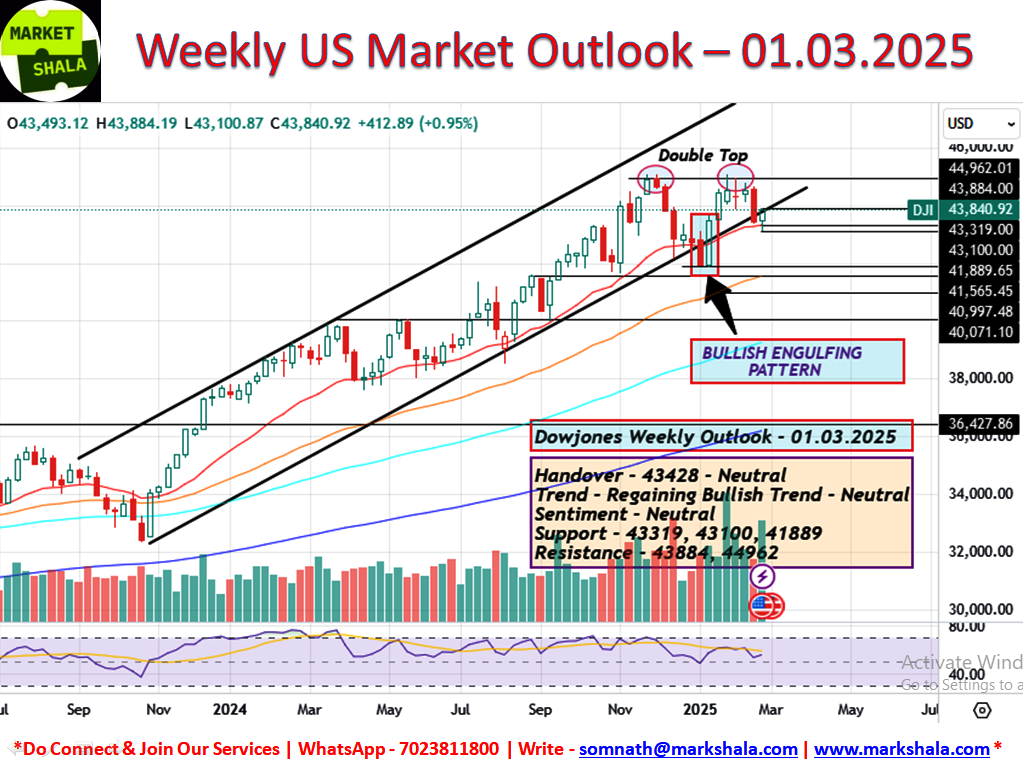

US Stock Market and Dowjones Trade Probabilities

The Dowjones index was trading with a decline throughout this week but on the last business day of the week, with an excellent rise, the Dowjones increased by 412 points and showed strength of .95%. If seen, yesterday proved to be an excellent day for world markets by removing the decline of the entire week, which worked to recover the losses of the entire week and yes, Indian markets are not being included in this. Perhaps the impact of the rise in world market on Monday can be seen in Indian markets.

For now if we talk about Dowjones, it is seen regaining the bullish trend on weekly charts. Next week approach should be kept on neutral side until its return to bullish trend is confirmed. A double top has formed on the charts which are called a bearish signal and it has not been breached yet. To fail the double top, it is necessary to cross the level of 44962. Next week Dowjones can be traded on both sides around the given levels with a cautious approach.

Respective Resistance and Support Levels are as follows:

Support – 43319, 43100, 41889

Resistance – 43884, 44962

Sentiment – Neutral

Trend – Regaining Bullish Trend – Neutral

Trade Bias – Both Side (Conditional)

India Stock Market and Trade Probabilities

Nifty Outlook and Trade Probability

Nifty future index maintained its downtrend this week also and registered a weekly fall of -542 points and -2.38%. Charts are showing weakness and in such a situation we will implement sell on rise strategy for next week. I am saying sell on rise because after continuous fall Nifty is trading in the oversold territory, so whenever we will find it near the below mentioned levels in the form resistance, trading Nifty on the short side can be an effective strategy for next week as well. The similar outlook as we mentioned last weak and implemented the same strategy on this week Nifty trades.

Respective Resistance and Support Levels are as follows:

Support – 22233, 22103, 21847

Resistance – 22657, 22720, 22807

Sentiment – Weak

Trend – Bearish

Trade Bias – Short Side (Conditional)

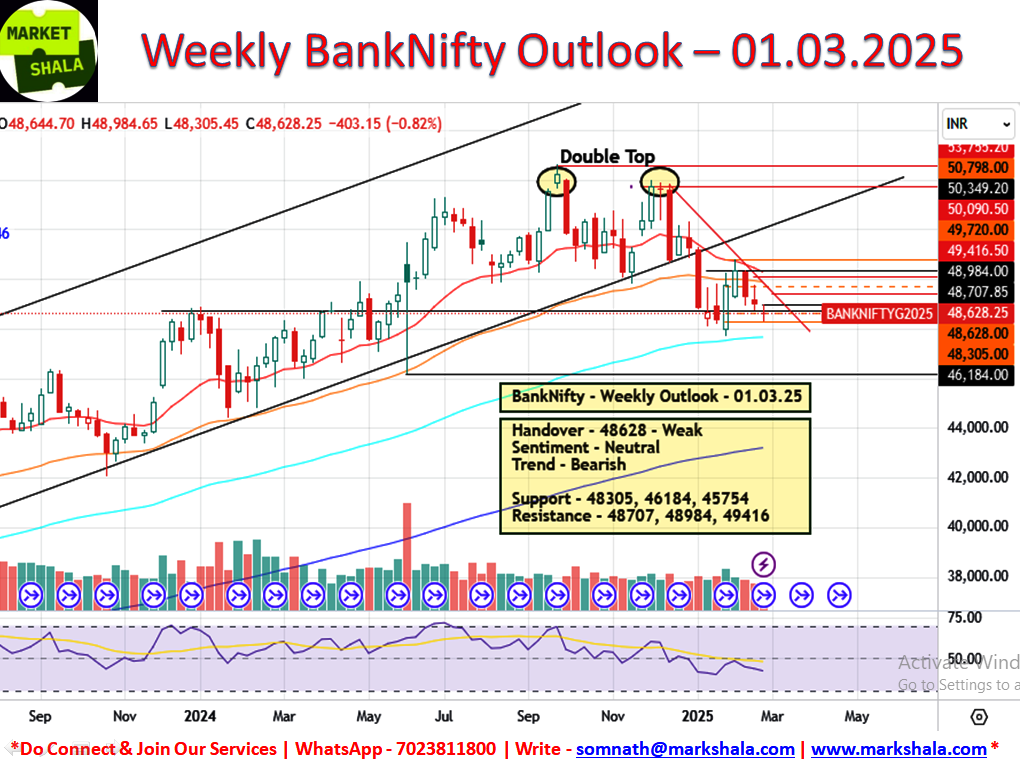

Bank Nifty Outlook and Trade Probability

Bank Nifty future index however registered a decline of -403 points and -0.82% as compare to the last week. If you look at the weekly charts, this week’s candle formation seems to be showing a faint ray of hope for the banking sector. Despite the handover being weak, we have kept the sentiments in the Neutral category. Hence next week our trading bias will remain on both sides near the below given levels. Whenever we get a chance, we will look for opportunities to take trades on both sides.

Respective Resistance and Support Levels are as follows:

Support – 48305, 46184, 45754

Resistance – 48707, 48984, 49416

Sentiment – Neutral

Trend – Bearish

Trade Bias – Both Side (Conditional)

Stock of the week (Long/Short)

Long Side Trade

This week HDFCBANK is coming in our setup where we will initiate the LONG side trade. Levels and Chart image is from the cash levels and it needs to be converted into the future levels if the position is being made in FnO. If it is not available in FnO then trade will be considered in the spot levels only.

Buy at the CMP / 1732.00, Stop Loss at 1701.00, Target at 1794.00 with a Risk Reward Ratio of 1:2

Short Side Trade

This week TORNTPOWER is coming in our setup where we will initiate the SHORT side trade. Levels and Chart image is from the cash levels and it needs to be converted into the future levels.

Sell at the CMP/1262.00, Stop Loss at 1321.00, Target at 1135.00 with a Risk Reward Ratio of 1:2.12

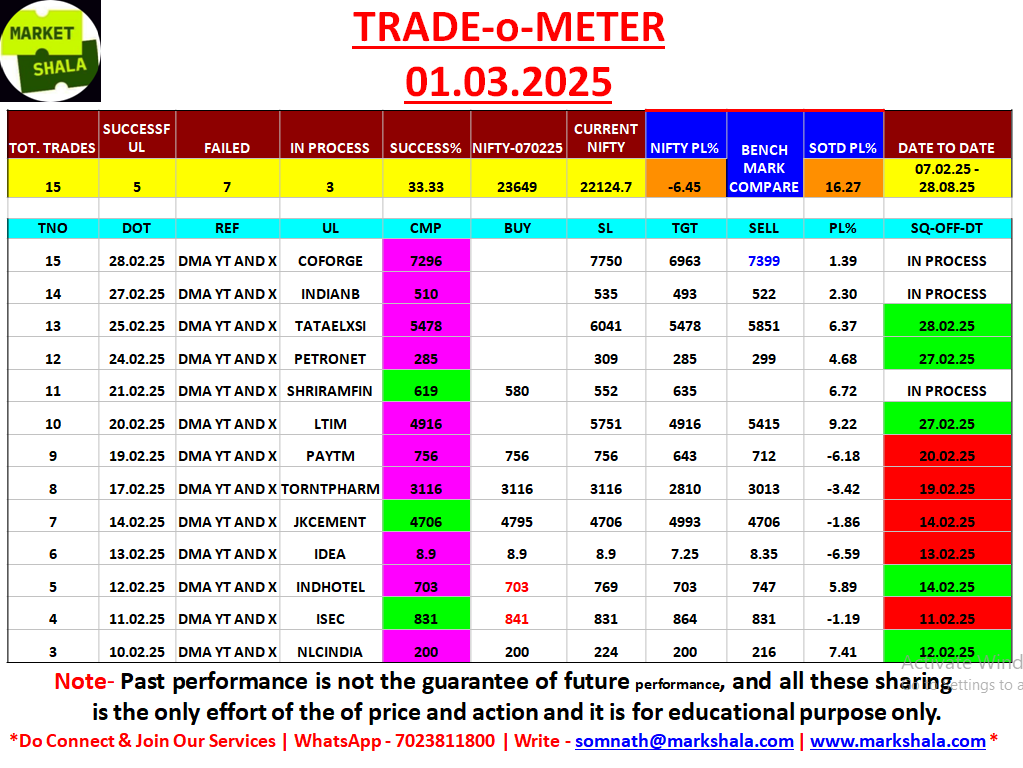

Trade – o – Meter

Under this heading we are setting up our performance report on the trade ideas we share in the segment of “Stock of the day” and “Weekly Long Short Stock Trade Idea”. Our effort behind incorporating this segment in our blog is to promote the learning of technical chart studies rather than to pat ourselves on the back by showcasing our trading success. We just want to bring a benchmark in front of you on a week on week basis which will prove that if trading business is adopted full time as other businesses with due learning and discipline then it can also take your career forward as any other mainstream profession.

Alternative Investments

Gold Outlook and Trade Probability

We mentioned in the last weekly wrap blog that the $2958 level in Gold will act as a resistance and you can see in this weekly chart that from exactly that level, selling pressure was witnessed in Gold which led to a weekly fall of -2.66% in Gold. The trend on the weekly charts in Gold is still on the bullish side but the sentiments are weak, so for the next week we will keep our trading strategy unbiased and will look for opportunities to trade on both sides around the below given levels.

Respective Resistance and Support Levels are as follows:

Support – $2837, $2798, $2769

Resistance – $2881, $2936, $2958

Sentiment – Weak

Trend – Bullish

Trade Bias – Both Side (Conditional)

Silver Outlook and Trade Probability

Silver also witnessed a sharp decline this week and recorded a weekly fall of -4.03%. The prices and actions of next week are going to be very important for silver as it will decide whether this is the beginning of another sub-bearish trend while remaining in a bullish trend? Only time will tell the answer to this question. For now, in terms of next week’s trading bias, we will have to look for opportunities to trade on both sides as the charts do not show any signs of trading with a single bias. So next week we will look for opportunities to trade on both sides near the below given levels.

Respective Resistance and Support Levels are as follows:

Support – $30.68, $30.13, $27.90

Resistance – $31.32, $31.93, $32.45

Sentiment – Weak

Trend – Bullish

Trade Bias – Both Side (Conditional)

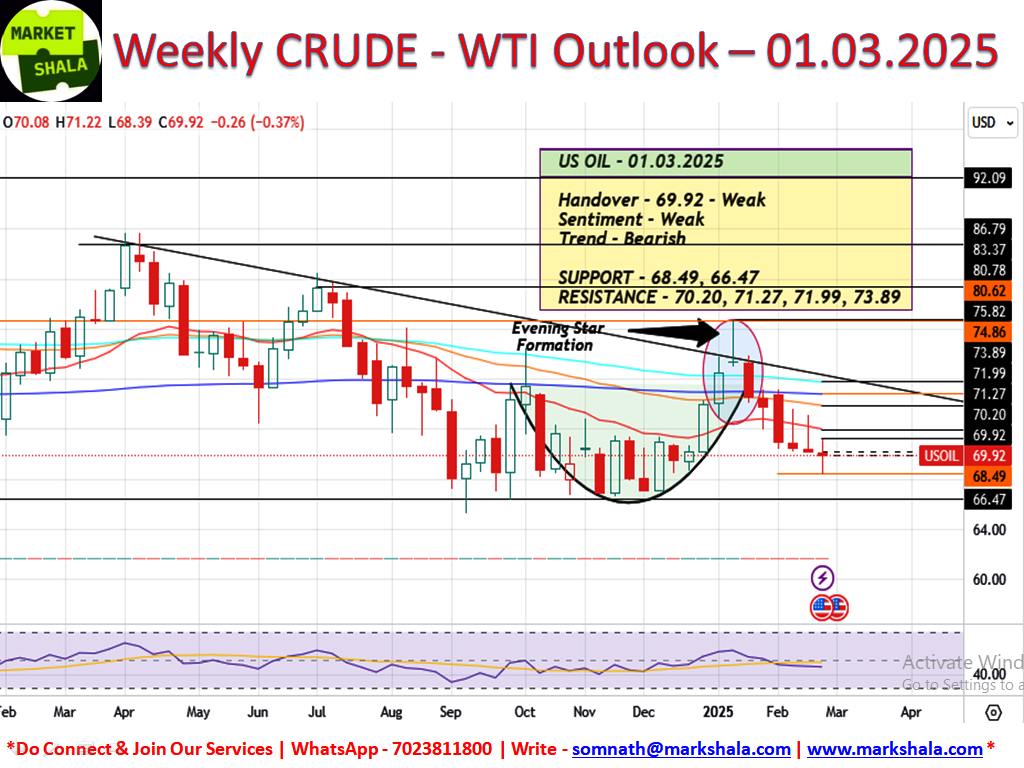

Crude Oil (WTI) Outlook and Trade Probability

Crude is forming lower highs and lower lows every week and we consider this as a bearish trend in the underlying. As we analyzed the last weak, this week some good short side trades were generated and traders would have made good trades on the short side. Crude registered a decline of -0.37% this week but showed trading in a large range throughout the week. Crude has a major support level at $66.47, traders should keep this level in mind and make short side trades. Our trading strategy on crude for the next week will remain on the short side and we will look for opportunities to short crude near the below given levels which are forming resistance. And whenever WTI Crude appears near $66.47, we will move towards booking profits.

Respective Resistance and Support Levels are as follows:

Support – $68.49, $66.47

Resistance – $70.20, $71.27, $71.99, $73.89

Sentiment – Weak

Trend – Bearish

Trade Bias – Short Side (Conditional)

Bitcoin Outlook and Trade Probability

It has been a big and painful week for Bitcoin or crypto investors where Bitcoin broke all supports and first breached its consolidation phase and then showed a little recovery after going near the lowest support level we had mentioned $76248.

MarketShalians, as I always say crypto is a very volatile asset class, so trading in it is a very risky job and traders must have faced the same situation this week as well. You will say that trading is a risky business in every asset class, then what you say is correct but there is no benefit in taking such a risk where you fail to plan and execute risk and reward and money management, and you must have seen scenario in crypto market due to crash in the last week. This is my personal view point regarding crypto trading; if you are making money by trading Bitcoin then you should continue with it.

Here we will cover what to do now in Bitcoin, as seen in the charts, there has been a little recovery from its lower levels. Bitcoin is such an underlying or asset class that will surely return to it’s recent levels and continue to maintain leadership in its segment. So investors should hold their bitcoins. And the time to accumulate will be when it comes near the given support levels or breaks out from the given resistance levels, then you can accumulate Bitcoin and yes, Bitcoin should not be more than 5%-10% of your overall portfolio. This is my personal outlook regarding asset allocation.

Respective Resistance and Support Levels are as follows:

Support – $84038, $78127, $76248

Resistance – $90399, $93336, $96628

Sentiment – Weak

Trend – Consolidation Phase Breached

Conclusion and disclaimer

The content on MarkShala.com is intended for educational and informational purposes only. We specialize in writing blogs on financial planning, investment strategies, economic trends, and related topics. While we strive to provide accurate and reliable information, the content should not be taken as professional financial, investment, or legal advice.

80% of Indians are NOT covered with proper Advisory for Wealth Creation, Right Insurance Protection and Financial Help!

Don’t be a part of the herd — take the first step and lead the way. Book a FREE call with MarketShala (WhatsApp – +91-7023811800 or Write at somnath@markshala.com) to learn more about the art of Right Investing, Insurance and find the best solution for you and your family.

Click Here and start your journey to invest in your first crypto currency.

Click Here and start your journey to invest in your first Stock, Index, Commodity and move ahead with your wealth creation journey.

How did you like our blog? Do share your thoughts in the comment box. Your thoughts will inspire us to bring more good and relevant content for you so that we can enhance the quality of our content and you can benefit more.

Thank you for tuning in to MarketShala’s Fin Dose — your essential source for insights into the financial markets, India and global economy, Don’t forget to share this story on your network.

Explore More on MarketShalaStay updated with insights on global events, market analysis, and investment strategies on Markshala, where we aim to make financial education accessible and actionable.Now, let’s shift gears and unwind! Treat yourself to the soothing tunes of MuziMuffin with his latest release available on Spotify, YouTube and Apple Music. Relax, recharge, and enjoy the vibe!

***********

|| ॐ नमः शिवाय ||