Hello MarketShalians, Welcome to the Weekly Stock Market Wrap, Trade tensions and inflation concerns have prevailed Global stock markets witnessed declines this week as fears of rising inflation and new tariff threats from U.S. President Donald Trump have raised trade war tensions. Trump announced a 25% tariff on auto imports and its impact was seen on auto industry stocks like India’s TATA MOTORS. More tariffs are expected next week. This has put pressure on the markets. All three major stock indices in the U.S. closed lower, with communication services, technology, and consumer discretionary sectors seeing the big declines. The Dow fell 1.69%, the S&P 500 went down 1.97% and the Nasdaq fell 2.7%. Gold prices, known as safe haven, have hit a new record high. Investors’ buying interest is increasing towards gold on trade war concerns and rising inflation. This is gold’s best quarterly performance since 1986. Treasury yields fell as investors are pricing in the economic impact of the new tariffs and the dollar is also weakening against major currencies. Inflation data showed inflation rising more than expectations. Oil prices were mostly flat as traders evaluated the implications of supply tightening and new tariffs.

US Consumer Sentiment is showing a decline, with US consumer confidence falling to its lowest level in two years as fear of new tariffs raised concerns of rising inflation and job insecurity. The University of Michigan reported consumer sentiment fell to 57.0 in March, well below 64.7 in February. Core PCE, the Federal Reserve’s favorite inflation measure, also rose, adding to negative sentiment. Due to this, the S&P 500 also saw a fall of 2% and European stock markets also closed in the red, which reflects overall economic concerns. An important news was heard during this period that Thames Water’s CFO Alastair Cochran has left his position amid financial restructuring and the growth of the UK economy in 2024 has been estimated to be stronger than before. Also, WH Smith sold its high street business to Modella Capital for £76 million and National World has received acquisition interest from Todd Boehly’s Eldridge Media Holdings. Global economic uncertainty grew further as Chinese President Xi Jinping urged CEOs to support global supply chains as US trade tariffs escalate.

Indian Stock Market Performance was seen outperforming all world indices till Thursday but in the last trading session of the week, profit booking was also seen in the Indian Stock Markets. It is possible that due to long weekend in the Indian stock markets, investors might have considered it appropriate to keep their positions light by showing a cautious approach. The FIIs who were playing the role of net buyers throughout the week, ended the week as net sellers on Friday. India’s Nifty 50 stock index has gained 6.3% in March, its best 15-month performance and helped recover from a historic five month losing streak. This surge helped the Nifty 50 secure a gain of 5.34% in the March 2025 fiscal year, while the BSE Sensex rose 5.1%. The rally has been driven by investors buying undervalued stocks, renewed foreign inflows and improving economic indicators. Foreign investors invested $2.65 billion in the last 5 trading sessions, but looking at the full fiscal year, the total outflow was -$15.57 billion. Nifty 50 is still down 10.5% from its late September peak, but market sentiment is positive for fiscal year 2026, with reasonable valuations and risk-reward of banking, oil & gas, and real estate sectors looking good. HDFC Securities estimates that Nifty earnings could grow 12% to 15% over the next 2 fiscal years.

So this was the overall discussion that we got to see this week in the worldwide economy and capital markets. Now let’s see what the charts are saying and what things traders should keep in mind while taking trades for the next week.

Table of Contents

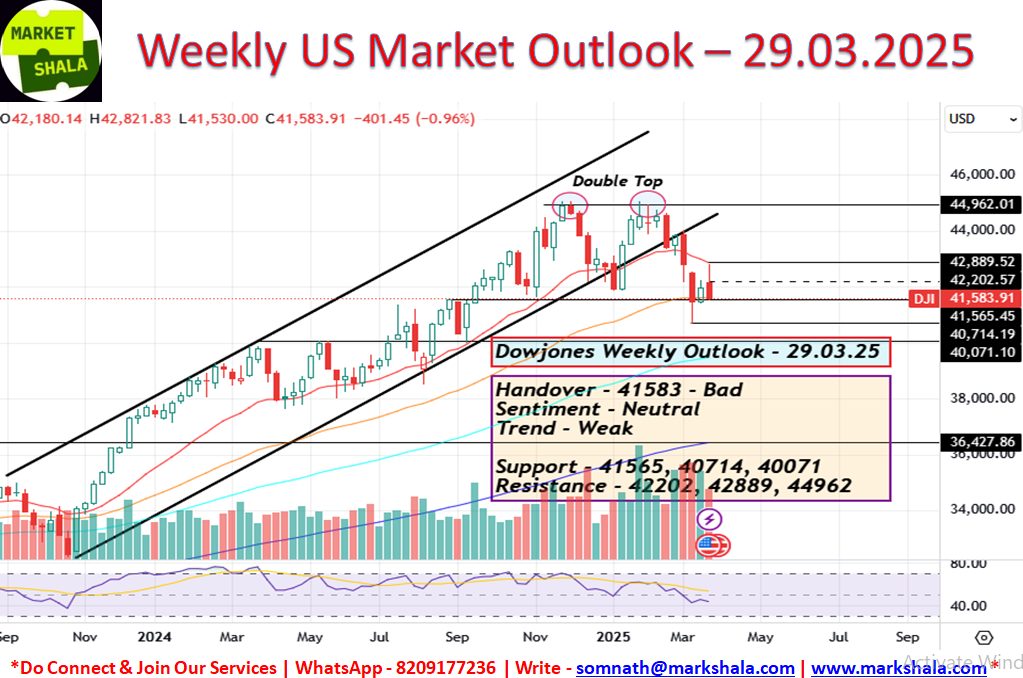

US Stock Market and Dowjones Trade Probabilities

Dowjone witnessed a fall of 0.96 percent this week. From trader’s point of view, the nearest support and resistance of last week i.e. 41565 and 42291 both played their roles very well and if you had taken trades accordingly, your trades would have surely made profits.

A consolidation phase is visible on the weekly charts since last 3 weeks. Hopes are stopping Dowjone from falling and the economic crisis created by the tarrif war is not allowing it to increase. So, which way should the trade be taken? The answer is that when there is such uncertainty, one should look at taking trades on both sides. Whenever the opportunity arises near the levels given below, one should look at the Dowjones next week for opportunities to take trades on both sides.

Respective Resistance and Support Levels are as follows:

Support – 41565, 40714, 40071

Resistance – 42202, 42889, 44962

Sentiment – Neutral

Trend – Weak

Trade Bias – Both Side (Conditional)

India Stock Market and Trade Probabilities

Nifty Outlook and Trade Probability

Nifty50 future index saw a rise of 1.10 percent this week. If traders had followed last week’s chart analysis, they must have made good profits. Nifty opened with a strong trend and its weekly low was equal to it’s open, the strategy of trading with a long side bias helped the traders and selling pressure was generated near the resistance level formed at monthly levels of 23853. The closing seen on the charts this week would be called a positive closing. Nifty’s trend is looking ready to reverse i.e. move from down to uptrend but let us wait for one more week for confirmation on this. Till then I must say that the confirmation of neutral trend from down trend which was needed has been achieved. Now we are no more into the downtrend which was going on since September 2024.

Now what to do next and how to prepare for next week’s trade, let’s discuss that. Nifty should now be traded on the long side. For the next week, whenever the opportunity arises, Nifty should be traded on the long side near the levels given below.

Respective Resistance and Support Levels are as follows:

Support – 23584, 23438, 23350, 22657

Resistance – 23853, 24321, 24826

Sentiment – Positive

Trend – Neutral with Positive Bias

Trade Bias – Long Side (Conditional)

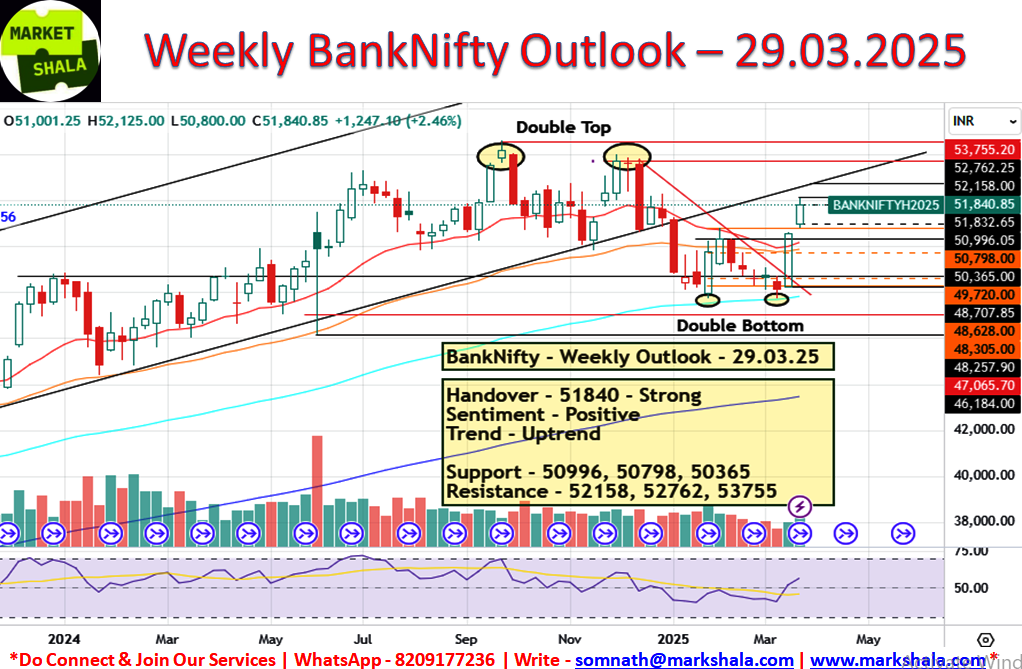

Bank Nifty Outlook and Trade Probability

Bank Nifty closed this week with as-expected gains and closed with a gain of 2.46 percent. The long side trading bias which we had taken into account in our last week’s Bank Nifty analysis proved to be correct and traders got an opportunity to make good profits. Bank Nifty opened with a good gap and secured handsome gains for itself.

The weekly chart of Bank Nifty indicates that it is fully set to move rapidly towards lifetime highs. We have already got the confirmation which we were still waiting for in Nifty in Bank Nifty that the trend has moved from down to neutral and has entered the uptrend phase. Bank Nifty is seen trading above all weekly major moving averages.

In the next week also, Bank Nifty should be traded with long side bias. Whenever there is an opportunity near the below mentioned levels, it would be a good strategy to initiate long trade on Bank Nifty.

Respective Resistance and Support Levels are as follows:

Support – 50996, 50798, 50365

Resistance – 52158, 52762, 53755

Sentiment – Positive

Trend – Uptrend

Trade Bias – Long Side (Conditional)

Stock of the week (Long/Short)

Long Side Trade

This week CEATLTD is coming in our setup where we will initiate the LONG side trade. Levels and Chart image is from the cash levels and it needs to be converted into the future levels if the position is being made in FnO. If it is not available in FnO then trade will be considered in the spot levels only.

Buy at the CMP / 2879.00, Stop Loss at 2810.00, Target at 3046.00 with a Risk Reward Ratio of 1:2.42

Short Side Trade

This week DRREDDY is coming in our setup where we will initiate the SHORT side trade. Levels and Chart image is from the cash levels and it needs to be converted into the future levels if the position is being made in FnO. If it is not available in FnO then trade will be considered in the spot levels only.

Sell at the CMP / 1144.00, Stop Loss at 1166.00, Target at 1095.00 with a Risk Reward Ratio of 1:2.13.

Alternative Investments

Gold Outlook and Trade Probability

Gold continued its bullish momentum this week as well and created new lifetime highs for itself with a gain of 2.04 percent at $3086.90. Gold is trading in its blue sky zone where there are no logical levels in the name of resistance. So shorting gold without logical levels can also prove to be a foolish move. Our readers, who are also traders, feel they must have made a lot of money by trading in gold, we can assume this. But there comes a time when it becomes important to be a little cautious. So what should be the strategy for trading gold next week? The answer to this is that till no logical levels are found, gold should not be shorted but at the same time it is important to avoid blindly taking trades on the long side. The only thing to do is that whenever the levels given below act as support then there is a possibility of earning better profit next week also by trading gold by staying on the long side with right risk and reward backed trade. But it is important to avoid taking compulsive long side trades.

Respective Resistance and Support Levels are as follows:

Support – $3005, $2958, $2854

Resistance – $3084

Sentiment – Strong

Trend – Bullish

Trade Bias – Long Side (Conditional)

Silver Outlook and Trade Probability

Silver witnessed a weekly close with gains as per the probability prediction. Silver closed with gains of 3.31 percent and continued its bullish trend. Silver is maintaining a strong momentum on the weekly charts and is seen reaching close to testing its lifetime highs. In the next week the strategy to trade Silver should be kept on the long side and whenever an opportunity is found near the below given levels, one should look for an opportunity to trade Silver on the long side.

Respective Resistance and Support Levels are as follows:

Support – $33.79, $33.37, $33.04, $32.89

Resistance – $34.63, $34.87, $36.07

Sentiment – Positive

Trend – Bullish

Trade Bias – Long Side (Conditional)

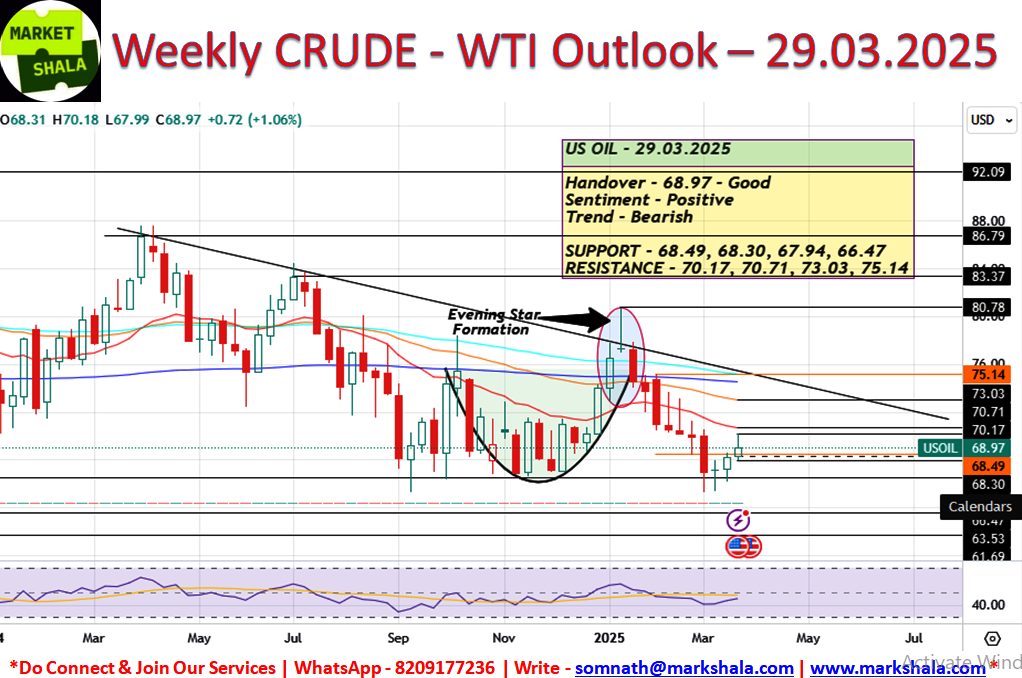

Crude Oil (WTI) Outlook and Trade Probability

Crude oil witnessed a decent positive closing this week. Crude closed with a gain of 1.06 percent. Back to back 3 weeks have been seeing higher highs and higher lows which is seen forming a bullish sentiment in the price and action of crude. But at the same time a big trend is still formed on the downside.

So then how should Crude Oil be traded next week? The answer is that until Crude does not decisively break the level of $67.94 at day close, Crude should be traded on the long side around the below given levels and once the level of $64.94 is broken, there should be no delay in switching the trading bias to the short side. So keep the trading strategy of next week conditionally on both sides.

Respective Resistance and Support Levels are as follows:

Support – $68.49, $68.30, $67.94, $66.47

Resistance – $70.17, $70.71, $73.03, $75.14

Sentiment – Positive

Trend – Bearish

Trade Bias – Both Side (Conditional)

Conclusion and disclaimer

The content on MarkShala.com is intended for educational and informational purposes only. We specialize in writing blogs on financial planning, investment strategies, economic trends, and related topics. While we strive to provide accurate and reliable information, the content should not be taken as professional financial, investment, or legal advice.

80% of Indians are NOT covered with proper Advisory for Wealth Creation, Right Insurance Protection and Financial Help!

Don’t be a part of the herd — take the first step and lead the way. Book a FREE call with MarketShala (WhatsApp – +91-8209177236 or Write at somnath@markshala.com) to learn more about the art of Right Investing, Insurance and find the best solution for you and your family.

Click Here and start your journey to invest in your first crypto currency.

Click Here and start your journey to invest in your first Stock, Index, Commodity and move ahead with your wealth creation journey.

How did you like our blog? Do share your thoughts in the comment box. Your thoughts will inspire us to bring more good and relevant content for you so that we can enhance the quality of our content and you can benefit more.

Thank you for tuning in to MarketShala’s Fin Dose — your essential source for insights into the financial markets, India and global economy, Don’t forget to share this story on your network.

Explore More on MarketShala Stay updated with insights on global events, market analysis, and investment strategies on Markshala, where we aim to make financial education accessible and actionable.Now, let’s shift gears and unwind! Treat yourself to the soothing tunes of MuziMuffin with his latest release available on Spotify, YouTube and Apple Music. Relax, recharge, and enjoy the vibe!

***********

|| ॐ नमः शिवाय ||