Table of Contents

Donald Trump’s return to the U.S. presidency in 2024 promises significant shifts in both the global and Indian economies. His “America First” policies, focusing on trade protectionism, deregulation, and tax cuts, will likely reverberate across multiple sectors. For India, these changes bring both opportunities and challenges, especially in trade, defense, pharmaceuticals, and financial markets. Below is a breakdown of how his policies could impact India’s economy and the broader global economic landscape.

Impact on India’s Economy and Key Sectors

1. Trade and Export-Driven Sectors

Trump’s potential re-implementation of universal tariffs and actions against Chinese imports could indirectly benefit Indian industries that can fill the gaps left by China. Sectors such as textiles, pharmaceuticals, and chemicals, where India is competitive, could see a boost. However, sectors like IT services and automotive, which heavily rely on the outsourcing of U.S. business, might face increased barriers due to higher tariffs or protectionist policies.

2. Pharmaceuticals and Healthcare

Indian pharmaceutical companies, which are major suppliers of generic drugs to the U.S., could benefit from Trump’s push to reduce drug prices in America. Trump’s approach, which encourages generic competition to drive down costs, could bolster India’s generic drug manufacturing sector. However, regulatory and pricing pressures might increase, and any potential trade restrictions could complicate Indian exports to the U.S.

3. Defense and Energy

Trump’s foreign policy, which favors increased defense spending and a focus on fossil fuels, aligns well with India’s interests. On the defense front, India may benefit from stronger defense collaborations, particularly those that reduce reliance on China for military technology and hardware. In terms of energy, Trump’s policies could lead to price fluctuations, especially concerning Indian oil imports, given his stance on U.S. energy production and exports. India’s energy security could be impacted by changes in U.S. energy policy.

4. Stock Market Volatility

Trump’s business-friendly tax policies could provide short-term gains in global stock markets, including in India. However, his unpredictable trade policies and potential market turbulence due to shifts in the dollar or interest rates could lead to volatility in the Indian stock market. Foreign investors might pull back if U.S.-India trade tensions rise, impacting capital flows and the rupee’s exchange rate.

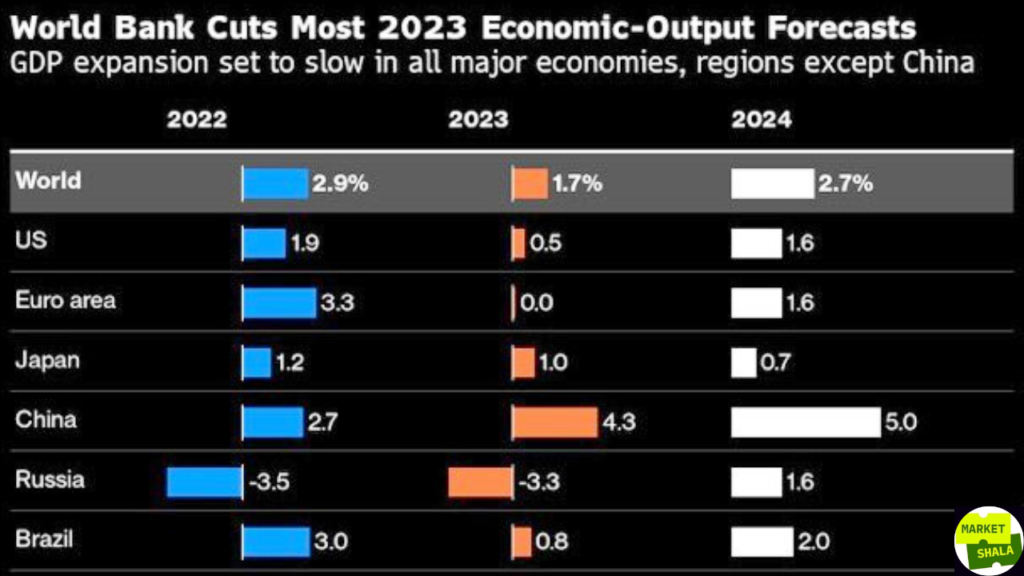

Global Economic Implications

1. Trade Relations and Global Supply Chains

Trump’s aggressive trade stance—particularly towards China—could lead to further fragmentation of global supply chains. Higher tariffs, reduced free trade agreements, and inflationary pressures from supply chain disruptions could hurt global growth. Countries like India, with export-dependent economies, may face challenges in adapting to these changes, even as some sectors may benefit from a shift away from China-centric supply chains.

2. Interest Rates and the Dollar

Trump’s influence on the U.S. Federal Reserve could lead to changes in interest rates and a stronger dollar. A higher dollar could attract capital to U.S. bonds, potentially leading to capital outflows from emerging markets like India. This would likely create volatility in the rupee, as the Indian currency might depreciate under the pressure of a stronger U.S. dollar. Indian companies with significant foreign debt could face higher repayment costs.

3. Geopolitical Tensions and Regional Security

Trump’s foreign policy is likely to continue to prioritize confrontation with China, a move that could benefit India, particularly in terms of strengthening U.S.-India defense and security ties. India’s strategic interests in countering China’s growing influence in Asia could see increased U.S. support, improving regional stability. This alignment could also strengthen India’s position in global geopolitics, particularly in South Asia and the Indo-Pacific region.

Impact of Musk’s Support for Trump on the EV Sector

Elon Musk’s endorsement of Trump adds a layer of complexity, particularly in the electric vehicle (EV) sector. As a major player in the EV market, Musk’s alignment with Trump could influence Tesla and the broader EV market in several ways:

1. Impact on Tesla and the EV Sector

Trump’s stance on reducing government subsidies for EVs could harm Tesla, as it relies heavily on incentives to maintain its competitive edge. Tesla’s profitability, already challenged by high operating costs and price adjustments, could suffer further under such a policy shift. For India, this could slow the growth of the local EV market, particularly if U.S. policy reduces the availability of subsidies for both producers and consumers in the EV ecosystem.

2. India’s EV Market and Manufacturing Potential

On a more positive note, Musk’s advocacy for minimal regulation and a focus on manufacturing could open opportunities for India. Tesla has shown interest in establishing local manufacturing in India, and a more deregulated U.S. environment might encourage Tesla to pursue such plans more aggressively. If U.S. policies align with India’s “Make in India” initiative, India could benefit from increased foreign investment in the EV sector.

3. Geopolitical and Regulatory Tensions

However, the broader shift away from green energy initiatives in the U.S. could pose a challenge to global clean energy collaboration, potentially affecting India’s ability to attract investment in the renewable energy and EV sectors. India’s focus on clean energy and reducing its carbon footprint could find itself at odds with U.S. policies if Trump’s government rolls back incentives for EVs and green technologies.

Conclusion

Donald Trump’s 2024 presidential victory brings both opportunities and uncertainties for India and the global economy. His protectionist trade policies, tax cuts, and energy-driven agenda will create short-term optimism in some sectors but also bring risks, particularly for those industries reliant on trade with the U.S. or dependent on global supply chains. India will need to navigate these complex dynamics, balancing the challenges of trade barriers and volatility with new opportunities in defense, pharmaceuticals, and energy.

For the global economy, Trump’s return to power will likely lead to further fragmentation, as countries adjust to the changing dynamics of U.S. trade policy. The influence of figures like Musk, especially in sectors like electric vehicles, will add an extra layer of complexity to global market trends. India’s ability to adapt to these shifts, while seizing new opportunities in security and technology, will be crucial in the coming years as the global order continues to evolve.

FAQ: Trump’s 2024 Presidency – Impact on India’s Economy

1. How will Trump’s 2024 return affect India’s economy?

Trump’s policies, such as trade protectionism, tax cuts, and deregulation, could bring both opportunities and challenges for India. Key sectors like pharmaceuticals, defense, and technology might experience shifts. For instance, Indian pharma companies could benefit from Trump’s push for cheaper drug prices in the U.S., while sectors like IT services may face barriers due to potential tariffs.

2. What are the implications of Trump’s “America First” policies for India?

Trump’s “America First” stance could lead to increased tariffs and trade restrictions, potentially slowing India’s export growth. However, it may also create new opportunities for Indian manufacturers to fill gaps left by reduced Chinese imports to the U.S. Sectors like textiles, automotive, and electronics could benefit from these changes.

3. How might Trump’s policies impact the EV sector, especially for India?

Trump’s opposition to EV subsidies could slow the global push toward electric vehicles, affecting companies like Tesla. However, India’s growing EV market may still benefit from Tesla’s potential expansion into India, especially if the U.S. adopts a less regulated approach to manufacturing. The shift could provide an opportunity for India’s EV manufacturers to grow and innovate.

4. Will Trump’s 2024 policies affect India’s stock markets?

Yes, India’s stock markets could experience volatility due to fluctuations in global trade relations and shifts in U.S. monetary policy under Trump. A stronger U.S. dollar and potential changes in interest rates might lead to capital outflows from emerging markets like India, affecting the stock market.

5. How does Elon Musk’s support for Trump influence India?

Musk’s endorsement of Trump could influence the U.S. approach to green energy and manufacturing, which could impact India’s growing EV sector. While reduced EV subsidies may slow global EV growth, India may still attract investment if Tesla chooses to expand locally. However, regulatory challenges could complicate India’s collaboration with U.S. companies.

6. What are the potential risks for India under Trump’s presidency?

The main risks include trade disruptions due to protectionist policies, currency volatility due to changes in the dollar, and the possibility of reduced foreign investment if U.S.-India relations worsen. India will need to navigate these challenges carefully while capitalizing on new opportunities in defense, healthcare, and energy.

Explore More on Markshala

Stay updated with insights on global events, market analysis, and investment strategies on Markshala, where we aim to make financial education accessible and actionable.

Thank you for tuning in to Market-Shala’s Fintalk Dose — your essential source for insights into the financial markets, India and global economy. Now, let’s shift gears and unwind!

Treat yourself to the soothing tunes of MuziMuffin with his latest release available on Spotify, YouTube, Apple Music and Amazon Music. Relax, recharge, and enjoy the vibe!

***********