Table of Contents

Should I Invest in Cryptocurrencies or Not? This is a Guide for the Investors in India and US (2024 Edition)

The investing world is changing rapidly today, and cryptocurrencies have become one of the most exciting but very volatile asset classes in the current scenario. Interest in Bitcoin, Ethereum, and other digital assets is growing, and many people are asking: “Should I invest in cryptocurrencies, is it safe?” In this 2024 guide, we will explore the potential of crypto investments, focusing on trends in India and the US, and try to understand whether these digital assets should be in your portfolio or not.

Cryptocurrency Boom in 2024: An Update

Since Bitcoin’s inception in 2009, cryptocurrencies have made significant strides.. At the start of 2024, the market cap of the global cryptocurrency market has exceeded $1.2 trillion and in last few days it surpassing $3 trillion due to investors optimism regarding U.S. President elect Donald Trump and his inclination towards Cryptocurrencies. Now it is equivalent to its peak in 2021, while current levels are approximately equal, but as the market recovers, these levels are surely going to reaching towards making new historical highs and showing stability. This effect is especially being seen on Bitcoin.

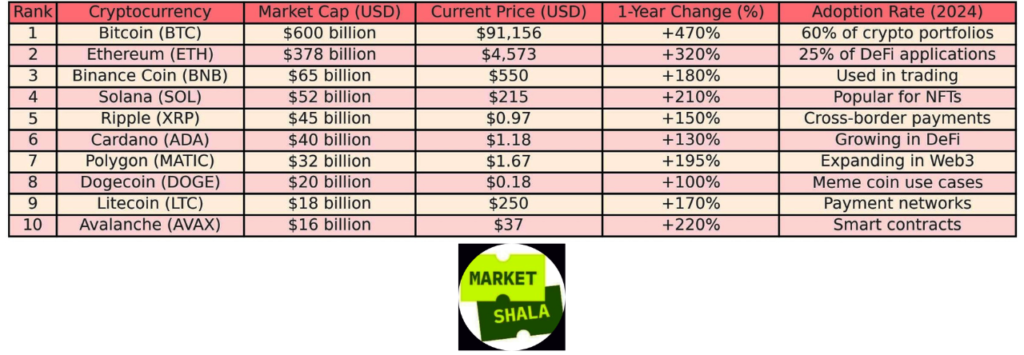

Bitcoin still reigns supreme among cryptocurrencies, with a current market cap of $600 billion, while Ethereum is in second place at $378 billion. At the same time, assets like Binance Coin, Solana, and Ripple have also gained momentum.

The popularity of cryptocurrencies has created a lot of curiosity among people and they are often found asking, “Should I invest in cryptocurrencies?”

What is the reason that investors are increasingly interested in Cryptocurrencies?

Some of the main reasons for investors’ interest in digital assets in 2024 are as follows:

1. Decentralized Nature and Security

Cryptocurrencies are based on a technology called blockchain, which is a decentralized system that ensures secure and transparent transactions. This peer-to-peer structure is a safeguard for those whose financial system wants more control over finance. In both India and the US, blockchain is offering an alternative to traditional banking, especially in areas where the financial infrastructure is not so strong.

2. Hedge Against Inflation

Cryptocurrencies are also being seen as a way to hedge against inflation. Global inflation rates are fluctuating in 2024, and cryptocurrencies, especially Bitcoin, are now being seen as a store of value. Bitcoin has a fixed supply of 21 million coins, which makes it inflation-resistant, which is not the case with fiat currencies as central banks can print them as per their convenience.

3. Growing interest of institutional investment

In 2024, institutional acceptance is also seen increasing towards cryptocurrencies. Big companies of the world like Tesla, MicroStrategy, and BlackRock are holding Bitcoin on their balance sheets. BlackRock also launched a Bitcoin ETF in 2023, which gives more legitimacy to crypto and its impact can be seen on the retail interest side as well.

4. DeFi and NFTs Revolutionizing the Financial System

Decentralized Finance (DeFi) and Non-Fungible Tokens (NFTs) have transformed finance and given the world a new view of the financial world. DeFi, which is based on the Ethereum blockchain, is giving users the opportunity to lend, borrow, and earn interest without traditional banks, which is a different and better control a new financial system is emerging, bringing greater control directly to the people.

Cryptocurrency Investment in India: A Growing Trend

Today, India has become one of the top cryptocurrency adopting countries in the world. According to Chainalysis’ 2024 report, India is ranked second in the global ranking, with 25 million crypto users from India currently participating. Exchanges like WazirX, CoinDCX, and ZebPay are working to strengthen India’s digital asset market and mature the related ecosystem.

Despite regulatory uncertainty in India, Indians are still curious: “Should they invest in cryptocurrencies?” Due to concerns about inflation and weakness of rupee, people are now starting to turn towards other assets as well.

Cryptocurrency Investment in the US: A Stable But Volatile Market

In the US, the cryptocurrency market has moved beyond the days of speculative trading. By 2024, there are approximately 46 million crypto users in the US, and the country is now a hub of blockchain and digital asset innovation. The SEC (Security and Exchange Commission) has given clearer guidelines to stabilize the market.

But despite this, volatility is still a concern. Bitcoin price has gone from $16,000 (early 2023) to $91,156 (present 2024), but sharp price swings are still seen.

Should I Invest in Cryptocurrencies? Pros and Cons

If you’re wondering, “Is investing in cryptocurrencies the right choice?” let’s explore the advantages and disadvantages below:

Pros

1. High Growth Potential:

Cryptocurrencies have shown explosive growth since inception. Experts are still seeing long-term growth potential in 2024 and this idea has become even more prominent after Trump became the U.S. President.

2. Diversification:

Cryptos are not correlated with stocks and bonds, so they can also act as a hedge during market downturns.

3. Global Accessibility:

To take exposure to Cryptos, all you need is an internet connection and you can start with your crypto investment journey from anywhere in this World.

4. Security and Transparency:

Blockchain technology makes transactions secure and fraud-proof and this is strength of this digital asset.

Cons

1. Extreme Volatility:

Cryptos like Bitcoin can fluctuate 5-10% in a day and that is enough to raise the heartbeats of any investor.

2. Regulatory Risks:

The rules are still unclear in India and the US. There are discussions on whether to legalize crypto in India or not. However, things seem to be turning in favor of Cryptocurrency after Trump became President in the US.

3. Security Risks:

Exchanges and wallets are a bit vulnerable and it will take some time to fully trust them. It is safer to store your assets in hardware wallets.

4. Market Manipulation:

Cryptos is still a young market and large investors (“whales”) can influence prices. As this market matures, the situation will change.

Conclusion: Should I invest in Cryptocurrencies or not?

If your risk tolerance is high, and you want to invest after understanding this market, then cryptocurrencies can be an exciting addition to your portfolio in 2024. But always remember: you have to be ready to lose the money you invest. Do thorough research, and stay updated about the latest regulations. Always keep in mind that high rewards are often accompanied by high risks.

FAQ: Should I invest in Cryptocurrencies?

1. What are Cryptocurrencies?

o Cryptocurrencies are digital or virtual currencies based on blockchain technology.

2. Should I invest in crypto in 2024?

o Crypto adoption is growing, but volatility is still high. If you can take the risk, you can invest in crypto to diversify.

3. What are the risks of cryptocurrency investment?

o Market volatility, regulatory uncertainty, and security vulnerabilities are major risks of crypto investments.

4. How can crypto investments be secured?

Use hardware wallets and enable two-factor authentication.

5. Can cryptocurrencies hedge against inflation?

o Cryptos like Bitcoin are being seen as an inflation hedge, especially during currency devaluation.

6. Are cryptocurrencies legal in India and the US?

o They are legal in the US, but the regulatory framework is still unclear in India.

7. How much should I invest?

o If you are new, start with a small portion (5-10%) of your portfolio and invest only what you are willing to lose.

Disclaimer: This article is for informational purposes only. Always seek advice from a financial expert before making any investment decisions.

Explore More on MarketShala

Stay updated with insights on global events, market analysis, and investment strategies on Markshala, where we aim to make financial education accessible and actionable.

Thank you for tuning in to Market-Shala’s Fintalk Dose — your essential source for insights into the financial markets, India and global economy. Now, let’s shift gears and unwind!

Treat yourself to the soothing tunes of MuziMuffin with his latest release available on Spotify, YouTube, Apple Music and Amazon Music. Relax, recharge, and enjoy the vibe!

***********