By Somnath Das | www.markshala.com

Table of Contents

Market Summary: How Nifty Futures Performed on Friday, 20 February 2026

The trading session on Friday, 20 February 2026 turned out to be highly eventful and productive for intraday traders. At the same time, it also offered stability and confidence to investors after the sharp decline witnessed in the previous session.

Nifty Futures opened near the upper boundary of the projected trading range at 25,423. Right from the opening minutes, strong buying interest was visible, and the price decisively broke above the resistance zone. This breakout was followed by a classic retest near 25,430, which gave traders sufficient time and clarity to initiate long positions in a controlled manner.

Once the breakout was confirmed, Nifty Futures displayed sustained upward momentum and moved sharply higher, delivering a total upward move of nearly 259 points. This directional movement provided traders with multiple opportunities to trail profits and exit according to their trading plans. Depending on individual strategy and discipline, traders were able to book profits ranging from 100 to 250 points.

Even traders who preferred a more conservative approach and followed a range-to-momentum trading framework managed to close the day with modest but consistent gains. This session once again demonstrated the strength of structured technical analysis, where trades are executed based on demand and supply dynamics rather than speculation or emotional reactions.

Over the course of the day, Nifty Futures registered a total trading range of nearly 298 points. When pre-defined technical levels allow traders to capture a significant portion of such movement, it reinforces confidence in systematic trading methods and disciplined execution.

Stock of the Day Review: UPL Performance on 20 February 2026

For Friday’s session, UPL was selected as the Stock of the Day based on its technical structure and price behaviour. The stock provided a favourable entry opportunity near 760, slightly below the planned entry zone of 765.

Throughout the trading session, UPL remained volatile, reflecting active participation from both buyers and sellers. By the end of the day, the stock closed at 752.35, registering a decline of around 1.66 percent. Despite this short-term weakness, the predefined stop loss level at 740 remained intact, keeping the trade setup technically valid.

The trade currently remains active, and its future direction will largely depend on broader market sentiment. If overall conditions improve in the coming sessions, UPL may attempt a recovery and gradually move towards its planned target zones. As always, strict risk management remains the key guiding principle.

Stock of the Day Performance Tracker: A Transparent Trading Journey

From 6 February 2026 onward, Markshala has consistently shared daily Stock of the Day ideas to provide traders with real-time exposure to disciplined trading practices. This initiative focuses not only on trade identification but also on maintaining transparency and performance accountability.

So far, a total of nine trades have been attempted under this segment. Out of these, seven trades have been closed, while two remain active. The current overall performance stands at a net gain of 17.53 percent. This continuous tracking aims to help traders understand the importance of patience, discipline, and systematic execution in building long-term consistency.

Broader Market Overview: Friday’s Market Behaviour

The broader equity market displayed a cautious and balanced tone throughout Friday’s session. Following the sharp fall seen on Thursday, market participants appeared reluctant to carry aggressive positions into the weekend, primarily due to ongoing geopolitical uncertainties.

Market breadth reflected this cautious sentiment, with nearly equal numbers of advancing and declining stocks. Around 1,395 stocks ended in positive territory, while approximately 1,532 stocks closed in the red. This near-neutral breadth indicates consolidation and lack of strong directional conviction.

Nifty Spot closed the day at 25,571, marking a modest gain of 0.46 percent. Technically, the zone around 25,414 acted as a reliable support area, as prices tested this level during the initial hours and managed to rebound.

However, despite the positive close, Nifty continued to trade below its 20-day and 50-day exponential moving averages. This indicates that the broader trend still lacks clarity, and traders should continue to adopt a day-by-day approach until a clear directional breakout is observed on the daily charts.

Nifty Futures Trading Strategy for Monday, 23 February 2026

The trading framework for Monday is based on a disciplined and rule-based structure, designed to reduce emotional involvement and enhance probability-driven outcomes. The focus remains on clarity of execution, controlled risk exposure, and limited trade frequency.

The core philosophy remains simple. A maximum of two trades should be taken during the session. Ideally, one trade may be based on range behaviour, while the second can be a momentum-based opportunity. If the first trade itself achieves its predefined target, traders are advised to refrain from taking any further trades for the day. This helps preserve mental capital and prevents overtrading.

If Nifty Futures opens within the predefined vacuum range, traders should wait patiently and observe which side of the range is tested first. If the price moves towards the upper boundary, a short-side opportunity may be considered. Conversely, if the lower boundary is tested first, a long-side trade may be planned. This ensures that trade decisions are guided by real-time price action rather than anticipation.

Once a range-based trade is initiated, two possible outcomes may unfold. In the first scenario, the market moves favourably and achieves the planned target, after which no further trades should be taken. In the second scenario, the market reverses sharply and begins to move decisively in the opposite direction, indicating the emergence of momentum. In such cases, traders may shift their focus from range trading to momentum-based strategies.

In case Nifty Futures opens with a significant gap-up or gap-down beyond the defined range, the range trading strategy becomes invalid for the day. Under such conditions, only momentum-based trades should be considered, with strict adherence to risk management principles.

Risk management remains central to this framework. For every trade, the stop loss should be limited to 50 points, while the minimum target should be 100 points. This ensures a favourable risk-to-reward ratio and supports long-term trading sustainability.

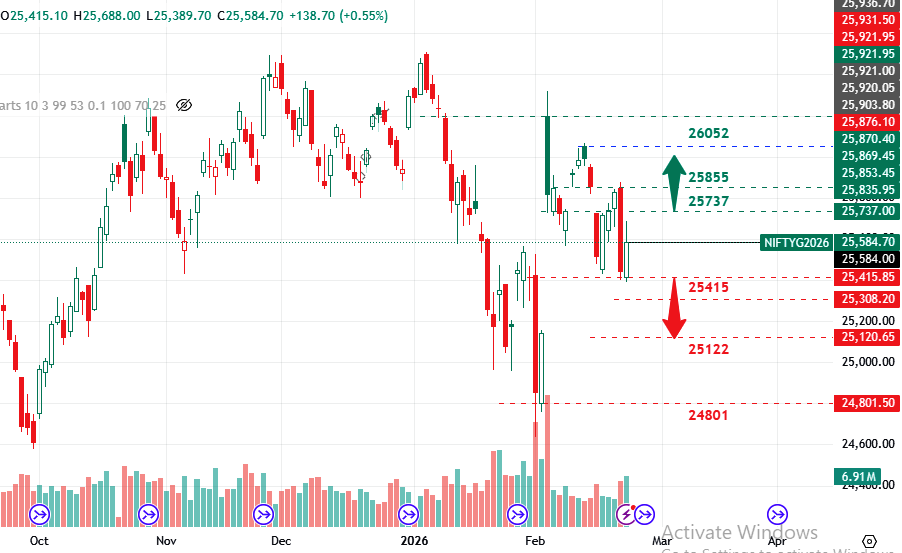

Key Trading Levels for Monday, 23 February 2026

If Nifty Futures opens within the vacuum range of 25,415 to 25,737, traders may consider initiating range-based trades near these boundaries, strictly following the outlined strategy.

A decisive move and sustained trading above 25,737 may open the door for long momentum trades. In such a scenario, the next resistance zones are expected near 25,855 and 26,052.

On the downside, if Nifty Futures trades decisively below 25,415, short momentum opportunities may emerge. The next support zones in this case are expected around 25,122 and 24,801.

Stock of the Day for Monday, 23 February 2026: Axis Bank

For the upcoming session, Axis Bank has been selected as the Stock of the Day based on its favourable technical structure and relative strength compared to the broader market.

The stock appears well positioned for a potential upward move, supported by improving price action and volume patterns. Traders may consider buying Axis Bank near the current market price of 1,368 or on minor intraday declines. The protective stop loss for the trade is placed at 1,337, while the initial upside target is positioned at 1,431.

The risk-to-reward ratio for this setup remains close to 1:2, aligning with disciplined trading principles. Beyond the first target, the stock also shows potential for extended upside, depending on overall market conditions.

Key Geopolitical Developments from the Last 24 Hours

Global developments continue to influence market sentiment, risk perception, and volatility. Over the last 24 hours, several geopolitical events have drawn the attention of financial markets.

Tensions between the United States and Iran escalated after Washington issued a 10 to 15-day ultimatum related to nuclear negotiations. This development led to increased military activity in the Middle East, triggering a sharp rise in crude oil prices. Brent crude crossed the 72-dollar-per-barrel mark, heightening concerns around inflation and global economic stability.

The Indian rupee weakened sharply, sliding close to the 91 mark against the US dollar. The depreciation was largely driven by foreign fund outflows, rising crude prices, and heightened geopolitical uncertainty. The Reserve Bank of India intervened in the market to curb excessive volatility.

In Europe, Ukraine successfully thwarted an alleged assassination plot targeting senior government officials, arresting multiple suspects. This incident has once again raised concerns regarding further escalation in the ongoing Russia–Ukraine conflict.

Meanwhile, North Korea held a rare party congress where its leadership announced ambitious military expansion plans, including advancements in missile and submarine capabilities. This development has added to geopolitical tensions in the East Asian region.

Conclusion: Strategy and Outlook

With geopolitical risks rising and volatility remaining elevated, traders and investors should adopt a cautious and disciplined approach. Markets currently lack a strong directional bias, making short-term, rule-based strategies more effective than aggressive positional bets.

Until a clear trend emerges on the daily charts, focusing on structured intraday setups, strict risk management, and capital preservation remains the most sensible approach.

MarkShala – Call to Action

Loved this analysis? Stay ahead in the markets with Markshala’s expert insights. Get deeper market research, trade setups, and investing guidance delivered straight to your inbox.

👉 For collaborations & queries: somnath@markshala.com

👉 WhatsApp Connect: +91 8209177236

Looking to invest in current NFOs or Bonds?

👉 Explore live investment opportunities here: Click Here

Click Here to join our partner Equity / Other Capital Market Investing Platform and unlock MarketShala’s expert-backed investing guidance. You may also join our WhatsApp community MarketShalians to stay tuned with regular updates in your wealth creation journey.

Click Here to join our partner in Crypto Currency Market Investing Platform and unlock MarketShala’s expert-backed investing guidance.

Stay informed. Stay profitable.

– Team Markshala

Disclaimer

The views and analysis provided above are for educational and informational purposes only and should not be considered as financial or investment advice. Trading and investing in the stock market involve risk, and past performance does not guarantee future results.

***********

|| ॐ नमः शिवाय ||