By Somnath Das | www.markshala.com

The Indian equity market witnessed a highly volatile and emotionally demanding session on Thursday, 19 February 2026. While intraday traders found excellent opportunities to capitalise on sharp price movements, long-term investors experienced significant stress as markets slipped sharply from higher levels. Rapid selling pressure, weak global cues, and rising geopolitical uncertainties combined to create a risk-heavy environment.

In this detailed analysis, we review today’s market action, discuss intraday trade performance, analyse stock-specific movement, evaluate global developments, and present a structured trading framework for Friday, 20 February 2026 based on technical and price action analysis.

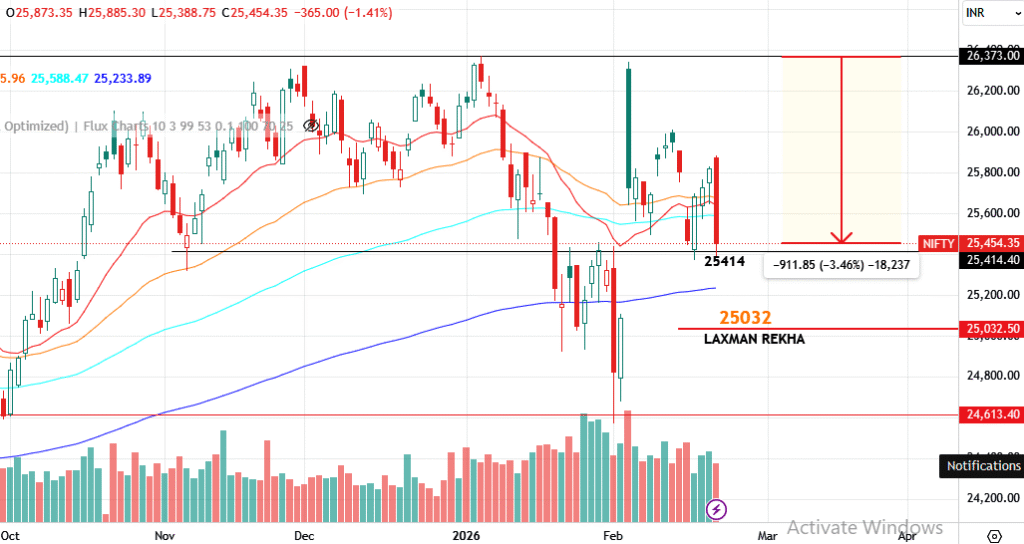

Market Recap: How Nifty Performed on 19 February 2026

Nifty Futures opened marginally above the projected upper trading range at 25,855. This initial gap-up opening invalidated the early expectation of a range-bound session. However, the market struggled to sustain at higher levels and selling pressure emerged within the first few minutes of trade.

As prices drifted lower, the crucial support level of 25,752 was tested. This level failed to hold, resulting in a decisive breakdown. Once this breakdown was confirmed, selling intensified and Nifty Futures witnessed a sharp fall of nearly 347 points from the breakdown zone. Traders who followed a disciplined approach and waited for confirmation were able to capture meaningful intraday opportunities.

Overall, the day recorded an intraday movement of nearly 473 points, reflecting heightened volatility. Such sessions once again highlighted the importance of patience, price confirmation, and disciplined execution.

Stock-Specific Performance Review

Bajaj Finserv – Stock of the Day (19 February 2026)

Bajaj Finserv opened with a gap-up, in line with expectations. However, broader market weakness limited its upside. The stock managed to provide an entry near 2068 and continues to trade above its critical support levels. The positional trade remains active, with the stop loss protected at 2013. Given the sharp decline in the broader market, any improvement in sentiment may lead to a recovery move in the stock.

Bandhan Bank – Positional Trade Update

The previously discussed positional trade in Bandhan Bank, initiated on 10 February 2026, successfully reached its target. This allowed timely exit and profit booking, reinforcing the value of structured planning, technical discipline, and patient execution.

Broader Market Overview: Understanding Today’s Sharp Decline

Thursday’s session demonstrated why equity investing is considered mentally demanding. Despite a positive opening, the market reversed sharply within the first ten minutes, leading to aggressive selling throughout the session.

Nifty Spot closed at 25,454, registering a decline of 1.41 percent. This move resulted in the breakdown of important short-term averages, including the 20-day, 50-day, and 100-day exponential moving averages. Market breadth was heavily negative, with significantly more stocks declining than advancing, indicating broad-based selling.

This fall was not simply routine profit booking. Escalating geopolitical tensions, particularly in the Middle East, along with rising crude oil prices, increased global risk aversion. Rising crude prices typically act as a negative factor for the Indian economy due to higher import costs and inflationary pressures. These developments collectively contributed to a risk-off sentiment in the market.

From a technical perspective, the daily structure of Nifty has weakened, making near-term forecasting challenging. The next trading session will play a crucial role in determining whether this move remains a temporary panic-driven correction or develops into a more sustained downtrend.

Trading Framework for Nifty Futures – Friday, 20 February 2026

The trading framework presented here is designed with a strong emphasis on discipline, clarity, and capital protection. The objective is to trade in alignment with price behaviour rather than anticipation, thereby improving decision-making and consistency.

Core Trading Philosophy

The strategy is built around taking a maximum of two trades in a session. Ideally, this consists of one range-based trade and one momentum-based trade. If the first trade achieves its target, traders are advised to stop trading for the day. This approach helps maintain emotional discipline and avoids unnecessary exposure to market noise.

Primary Trade Setup Logic

If Nifty Futures opens within the predefined vacuum range of 25,430 to 25,308, traders should exercise patience and closely observe price behaviour before taking any position. The primary objective is to identify which side of the range is tested first.

If the market moves upward and approaches the upper boundary near 25,430, traders may consider short-side opportunities near this region, provided price action signals rejection. Conversely, if the market moves downward and tests the lower boundary near 25,308, long-side opportunities may be considered if supportive price behaviour emerges.

This approach ensures that trades are driven by real-time market confirmation rather than prediction, which significantly improves trade quality and consistency.

Trade Progression Framework

Once a range-based trade is initiated, the market can evolve in two distinct ways.

In the first scenario, the price moves in the anticipated direction and achieves the predefined target of 100 points. In such cases, traders should book profits and avoid initiating any further trades for the day. This discipline helps preserve gains and prevents emotional overtrading.

In the second scenario, the price fails to sustain within the range and starts moving decisively in the opposite direction, indicating a possible breakout or breakdown. Under such conditions, the trading focus shifts from range-based setups to momentum-based trades, allowing traders to participate in directional price expansion.

This adaptive framework allows traders to respond dynamically to changing market conditions while maintaining structured execution.

Strategy for Gap-Up or Gap-Down Openings

If Nifty Futures opens outside the predefined vacuum range due to a significant gap-up or gap-down, the range trading strategy becomes irrelevant for the session. In such situations, traders should focus exclusively on momentum-based setups, waiting for confirmation before entering positions. Forced entries must be avoided, as gap sessions often exhibit heightened volatility and rapid price swings.

Risk Management Guidelines

Risk management remains the backbone of this trading framework. For every trade, the stop loss should be strictly limited to 50 points, while the minimum profit target should be maintained at 100 points. This ensures a minimum risk-to-reward ratio of 1:2, which is essential for long-term capital protection and consistent trading performance.

Key Trading Levels for Friday, 20 February 2026

If the market opens within the range of 25,430 to 25,308, traders may look for range-based opportunities using the above framework.

If Nifty Futures trades decisively above 25,430, a long momentum trade may be considered, with resistance zones observed near 25,752 and 25,853.

If Nifty Futures trades decisively below 25,308, short momentum opportunities may emerge, with potential support levels seen near 25,122 and 24,801.

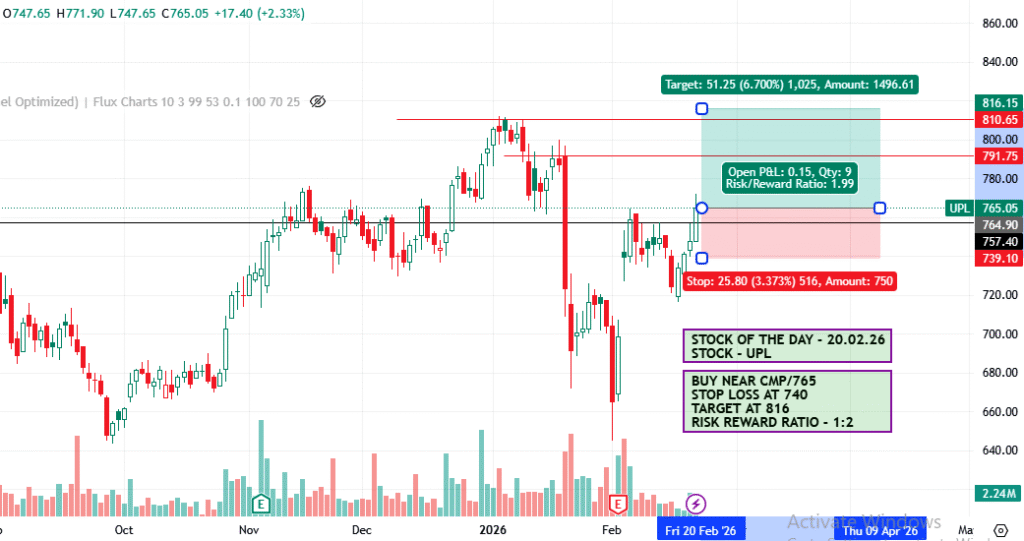

Stock of the Day – Friday, 20 February 2026: UPL

UPL is showing constructive technical structure on the daily charts and appears well-positioned for a recovery move. Traders may consider buying the stock near the current market price of 765, with a protective stop loss at 740. The first target is placed near 816. Based on this structure, the trade offers a favourable risk-to-reward profile, while higher targets remain possible if momentum strengthens.

Key Global and Geopolitical Developments (Last 24 Hours)

Over the past 24 hours, several global developments influenced market sentiment. Crude oil prices surged to six-month highs due to rising tensions between the United States and Iran, raising concerns about potential supply disruptions through the Strait of Hormuz. Meanwhile, peace talks between Russia and Ukraine once again failed to deliver a breakthrough, keeping geopolitical risks elevated in Europe.

Additionally, the US Federal Reserve adopted a hawkish tone in its recent commentary, raising concerns about potential future rate hikes if inflation remains persistent. On the positive side, UK inflation data showed a decline to a ten-month low, improving expectations of interest rate cuts in the near future.

Together, these developments contributed to heightened global volatility and cautious investor sentiment.

Final Market Outlook

With rising geopolitical uncertainties, elevated crude oil prices, and weakening technical structure, market volatility is likely to remain high in the near term. However, disciplined traders who follow structured setups, strict risk management, and price confirmation techniques may continue to find selective opportunities.

Friday’s session will be critical in determining whether the market stabilises or extends the corrective phase. Traders are advised to stay cautious, remain patient, and avoid emotionally driven decisions.

MarkShala – Call to Action

setups, and investing guidance delivered straight to your inbox.

👉 For collaborations & queries: somnath@markshala.com

👉 WhatsApp Connect: +91 8209177236

Looking to invest in current NFOs or Bonds?

👉 Explore live investment opportunities here: Click Here

Click Here to join our partner Equity / Other Capital Market Investing Platform and unlock MarketShala’s expert-backed investing guidance. You may also join our WhatsApp community MarketShalians to stay tuned with regular updates in your wealth creation journey.

Click Here to join our partner in Crypto Currency Market Investing Platform and unlock MarketShala’s expert-backed investing guidance.

Stay informed. Stay profitable.

– Team Markshala

Disclaimer

The views and analysis provided above are for educational and informational purposes only and should not be considered as financial or investment advice. Trading and investing in the stock market involve risk, and past performance does not guarantee future results.

***********

|| ॐ नमः शिवाय ||