By Somnath Das | www.markshala.com

Market Overview: Indian Market Performance on Wednesday

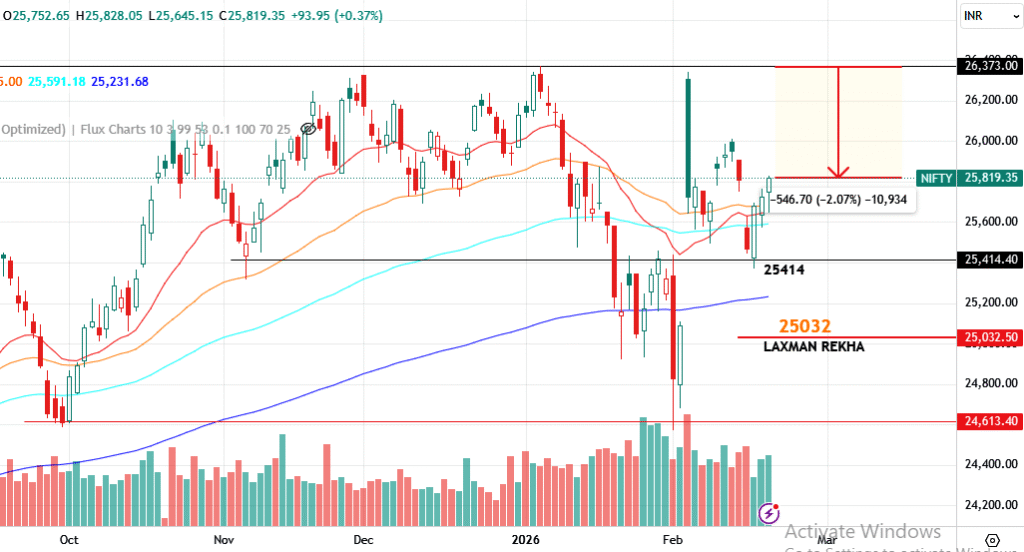

The Indian equity market witnessed a highly volatile but constructive trading session on Wednesday, 18 February 2026. The day began on a weak and cautious note as investors remained watchful amid mixed global cues and ongoing geopolitical developments. However, as the session progressed, buying interest gradually improved, particularly in the second half, enabling the benchmark indices to recover sharply from their intraday lows.

On a closing basis, Nifty spot ended the session at 25,819, registering a gain of 93 points. The early weakness tested important technical levels, including the 20 and 50-day exponential moving averages. However, sustained buying pressure later in the day helped the index regain lost ground, reflecting resilience and improving sentiment. Market breadth also improved meaningfully during the second half, with 1,586 stocks advancing against 1,331 declines, indicating healthy participation beyond just the frontline indices. Overall, the session highlighted a strong underlying market structure, supported by institutional buying and disciplined accumulation.

Nifty Futures Intraday Analysis: Price Action and Volatility

Nifty Futures traded within a range of approximately 185 points during the session, reflecting heightened intraday volatility. From the opening bell until around 2 PM, price action remained largely confined within a narrow vacuum zone between 25,777 and 25,643. This prolonged sideways movement suggested indecision and cautious positioning among market participants.

The decisive move unfolded after 2 PM, when Nifty Futures managed to break above the upper boundary of the consolidation range. This breakout triggered fresh buying interest, resulting in an upward move of nearly 67 points into the close. Despite this late-session momentum, none of the predefined intraday trading setups were triggered effectively, making it a challenging day for short-term traders.

Such price behaviour, characterised by extended consolidation followed by directional movement, often indicates accumulation by larger market participants and is typically considered a constructive technical signal.

Stock of the Day Review: Dabur India

Dabur India was identified as the Stock of the Day for Wednesday based on its favourable technical setup. The stock opened with a strong gap-up near the 525 level, indicating positive sentiment at the opening. However, intense selling pressure emerged within the first few minutes of trade, erasing the entire gap-up and triggering the predefined stop-loss level.

The sharp reversal appears to be linked to recent corporate developments, including changes in top management and subsequent downgrades by select research agencies. These factors likely resulted in heavy profit booking by institutional participants, leading to sudden intraday weakness.

Given the speed and magnitude of the decline, retail traders may have found it difficult to enter positions at favourable levels. This development once again underlines the importance of strict risk management and disciplined stop-loss execution.

Positional Trade Performance Update

Two previously discussed positional trade ideas, ICICI Lombard and Schneider Electric, successfully achieved their respective targets. These outcomes reinforce the effectiveness of structured trade planning, disciplined execution, and patient holding in positional trading strategies.

Broader Market Structure and Technical Outlook

From a technical standpoint, the overall market structure continues to remain constructive. The formation of back-to-back higher highs and higher lows for the second consecutive session reflects a strong bullish undertone. Delivery volumes also remained healthy, suggesting genuine participation rather than speculative short-term trading.

The IT sector, however, remained under pressure due to persistent concerns related to artificial intelligence-led business model disruptions and margin uncertainties. Despite this sectoral weakness, the broader market maintained stability, supported by selective buying in financials, FMCG, and infrastructure-linked stocks.

At present, the market appears to be in a phase of controlled accumulation, indicating that the broader trend remains positive, subject to global stability and domestic macroeconomic conditions.

Nifty Futures Trading Strategy for Thursday, 19 February 2026

The trading framework for Nifty Futures is built on a disciplined, rule-based approach designed to maintain emotional control, preserve capital, and optimize probability-based outcomes. The emphasis remains on clarity of execution, controlled risk exposure, and limited trade frequency.

Core Trading Philosophy

A maximum of two trades should be taken during the session, ideally in the form of one range-based trade and one momentum-based trade. If the first trade itself achieves the target, it is advisable to refrain from initiating any further trades for the day. This approach helps maintain psychological discipline and prevents overtrading.

Primary Trade Setup Logic

If Nifty Futures opens within the predefined vacuum range of 25,852 to 25,752, traders should remain patient and observe price behaviour before initiating any trade. The focus should be on identifying which boundary of the range is tested first.

If price moves toward and tests the upper boundary of 25,852 first, a short-side trade may be considered near this level. Conversely, if the lower boundary of 25,752 is tested first, a long-side trade may be considered near this zone. This method ensures that trades are aligned with real-time price action rather than anticipation.

Trade Progression Framework

Once a range trade is initiated, two distinct scenarios can unfold.

In the first scenario, the market moves favourably and achieves the predefined target of 100 points. In such a case, traders should close the trade and avoid any further entries for the day.

In the second scenario, the market reverses and begins to move decisively in the opposite direction, indicating a potential breakout. Under such conditions, the focus shifts from range trading to momentum trading, allowing traders to participate in directional price movement.

This adaptive framework enables traders to respond dynamically to evolving market conditions while maintaining discipline.

Gap-Up or Gap-Down Opening Strategy

If Nifty Futures opens outside the defined vacuum range due to a significant gap-up or gap-down, the range trading strategy stands nullified for the session. In such situations, only momentum-based trades should be considered, ensuring strict adherence to risk-reward parameters and avoiding forced entries.

Risk Management Rules

Risk management remains the backbone of this trading framework. For every trade:

- Stop-loss should be strictly limited to 50 points.

- Minimum profit target should be maintained at 100 points.

This ensures a favourable risk-to-reward ratio of at least 1:2, enabling long-term capital protection and consistency.

Trading Levels for Thursday, 19 February 2026

If Nifty Futures opens within the vacuum range of 25,852 to 25,752, range-based trades may be considered using the above framework.

If Nifty Futures trades decisively above 25,852, a bullish momentum trade may be considered. In this case, the first resistance is expected near 26,050, followed by a second resistance around 26,200.

If Nifty Futures trades decisively below 25,752, a bearish momentum trade may be considered. In this scenario, the first support lies near 25,643, followed by a second support around 25,429.

Stock of the Day for Thursday, 19 February 2026: Bajaj Finserv

Bajaj Finserv has been identified as the Stock of the Day based on its strong technical structure, positive price action, and improving volume participation.

A buying approach may be considered near the current market price of around 2060, with a protective stop-loss placed at 2013. The first target is set at 2154, offering a risk-to-reward ratio of approximately 1:2. Technical indicators suggest the possibility of further upside beyond the initial target, subject to overall market conditions.

Key Geopolitical and Global Economic Developments (Last 24 Hours)

Global developments continue to influence market sentiment and asset pricing across regions.

The United States announced the formation of a strategic critical minerals trading alliance aimed at securing lithium, cobalt, copper, and rare earth supply chains. This initiative is expected to reshape supply dynamics for electric vehicles, green energy infrastructure, semiconductor manufacturing, and global commodity markets.

China’s policymakers signalled fresh fiscal stimulus and increased infrastructure spending to revive domestic demand and stabilise economic growth. This development boosted sentiment across Asian markets and is likely to support commodity prices and emerging market equities.

Crude oil prices surged amid renewed geopolitical tensions in the Middle East, raising concerns over supply disruptions near major shipping routes. Elevated oil prices may increase inflationary pressures and impact India’s trade balance.

The Reserve Bank of India intensified its liquidity surveillance measures in response to rising oil prices, currency volatility, and global uncertainty, reflecting its commitment to maintaining macro-financial stability.

Meanwhile, weak manufacturing and consumption data from the Eurozone revived concerns of economic slowdown, triggering risk-off sentiment and supporting safe-haven asset demand.

Final Market Outlook

The Indian equity market continues to demonstrate structural strength supported by improving breadth, disciplined institutional participation, and constructive price patterns. While geopolitical uncertainties and global volatility may cause intermittent fluctuations, the underlying trend remains positive.

Traders are advised to maintain disciplined execution, strict risk management, and emotional control, while investors should continue to focus on fundamentally strong businesses with sustainable long-term growth prospects.

MarkShala – Call to Action

Loved this analysis? Stay ahead in the markets with Markshala’s expert insights. Get deeper market research, trade setups, and investing guidance delivered straight to your inbox.

👉 For collaborations & queries: somnath@markshala.com

👉 WhatsApp Connect: +91 8209177236

Looking to invest in current NFOs or Bonds?

👉 Explore live investment opportunities here: Click Here

Click Here to join our partner Equity / Other Capital Market Investing Platform and unlock MarketShala’s expert-backed investing guidance. You may also join our WhatsApp community MarketShalians to stay tuned with regular updates in your wealth creation journey.

Click Here to join our partner in Crypto Currency Market Investing Platform and unlock MarketShala’s expert-backed investing guidance.

Stay informed. Stay profitable.

– Team Markshala

Disclaimer

The views and analysis provided above are for educational and informational purposes only and should not be considered as financial or investment advice. Trading and investing in the stock market involve risk, and past performance does not guarantee future results.

***********

|| ॐ नमः शिवाय ||