By Somnath Das | www.markshala.com

Market Summary: How Nifty Performed on Monday, 16 February 2026

The Indian equity market witnessed a strong and highly volatile trading session on Monday, offering an ideal environment for intraday traders who thrive on momentum-driven price action. Nifty Futures displayed sharp directional movement, healthy volume participation, and a wide intraday range, all of which contributed to an engaging and dynamic market structure.

That said, traders who strictly follow pre-defined trading setups did not receive a direct opportunity at the discussed technical levels. Intraday trading broadly follows two approaches. One is rule-based trading with predefined price levels and setups, while the second is screen-based trading, which depends on live market observation, moving averages, price behavior, and momentum indicators.

Monday’s market favored screen-based traders. Due to the strong directional movement seen on Friday, price levels were significantly stretched, making it difficult to define fresh nearby levels with acceptable risk. Under such circumstances, attempting speculative entries often leads to unfavorable risk-reward situations. As a result, no trades were executed based on the predefined setup approach.

During the session, Nifty Futures registered an impressive intraday movement of nearly 295 points. The lower range near 25,290 was never tested, highlighting the underlying bullish bias. As the session progressed, the market gradually moved higher and finally broke above the 25,684 level in the last trading hour. However, initiating fresh intraday positions during the final hour is generally avoided due to unfavorable risk management dynamics and reduced opportunity for meaningful price extension.

Traders with strong screen-reading skills, combined with the disciplined use of moving averages and momentum indicators, would have found multiple opportunities on the long side during the day. Such trading skills develop over time through experience, observation, and disciplined execution.

Stock of the Day Performance: Campus Activewear

For Monday, 16 February 2026, our Stock of the Day was Campus Activewear. During the session, the stock showed mild weakness and ended the day with a decline of approximately 0.95 percent.

The trade entry was achieved comfortably within the discussed zone of 272 to 270. The position continues to remain active, supported by a protective stop-loss placed at 268. As of now, the technical structure remains intact. A gradual improvement in market sentiment and sectoral participation may help the stock regain strength in the coming sessions.

It is important to note that stock-specific trades require patience, disciplined risk management, and an objective assessment of price action rather than emotional decision-making.

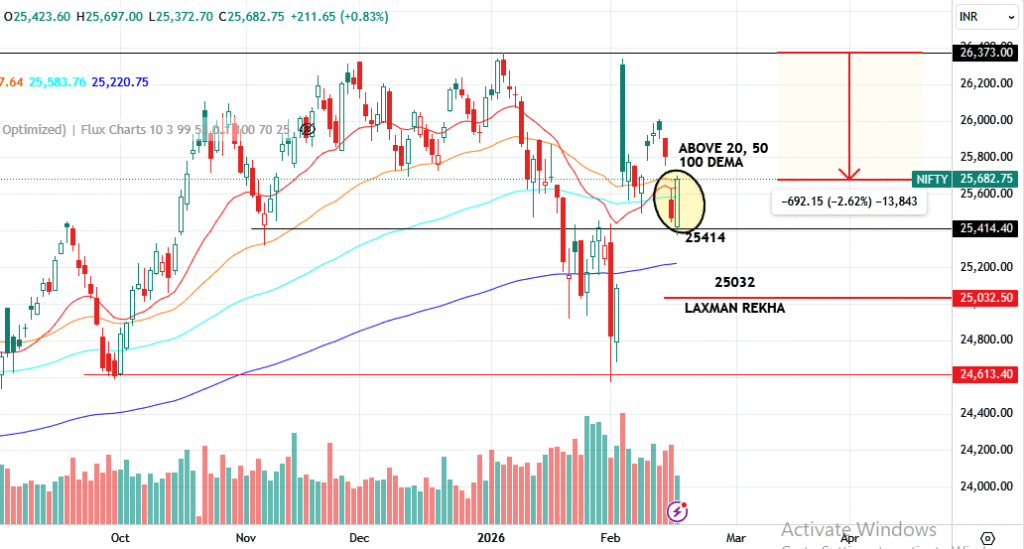

Nifty Spot Analysis: Bulls Regain Momentum

The market sentiment improved significantly, with Nifty Spot closing higher by around 0.83 percent at the 25,682 level. This closing holds substantial technical importance.

In the previous trading session, Nifty had closed below its 20-day, 50-day, and 100-day exponential moving averages, all in a single day. Such a breakdown typically reflects strong selling pressure and a short-term loss of momentum. However, Monday’s session completely reversed this technical damage. Nifty managed to reclaim all three moving averages and closed decisively above them, signaling renewed bullish strength.

From a technical standpoint, the support zone near 25,414 played a crucial role in stabilizing the market. The reversal from this level suggests that buyers are actively defending lower levels, thereby restoring market confidence after two sessions of weakness.

Nevertheless, confirmation of sustained bullish momentum will only be established if Nifty manages to hold above the 20-day exponential moving average in the next session. Traders should closely monitor price behavior around this zone for directional clarity.

Market Breadth Remains a Cautionary Signal

Despite the sharp rise in the index, the internal strength of the market remained relatively weak. A higher number of stocks ended the session in the red compared to those that advanced. This divergence suggests that the rally was primarily driven by a limited set of heavyweight stocks, while broader participation from mid-cap and small-cap segments remained subdued.

For a healthy and sustainable market uptrend, broader market participation becomes essential. The recent lack of strength in mid-cap and small-cap stocks indicates that traders should maintain a cautious approach while managing risk efficiently.

Nifty Trading Strategy for Tuesday, 17 February 2026

For the upcoming trading session, Nifty Futures is expected to remain within a defined range, unless strong momentum triggers a directional breakout or breakdown.

The anticipated trading zone for Tuesday is between 25,536 and 25,743.

If the market remains range-bound, a structured range trading approach may be considered. Traders can look for short opportunities near the upper boundary and long opportunities near the lower boundary, always ensuring disciplined stop-loss management and favorable risk-reward ratios.

In case of a bullish breakout, where Nifty Futures sustains convincingly above 25,743, a momentum-based long setup may emerge. Under such circumstances, buying above this level with a controlled stop-loss and moderate target can be considered. Immediate resistance levels are expected near 25,852 and 26,050, which may act as potential supply zones.

On the other hand, if Nifty Futures breaks and sustains below 25,536, a bearish momentum setup may develop. In this scenario, short positions may be initiated with strict risk management. The nearest support zones to monitor would be around 25,430 and 25,293.

Trading Discipline and Risk Management Guidelines

Trading Discipline and Risk Management Guidelines

Maintaining discipline is a cornerstone of consistent trading performance. Limiting the number of trades and maintaining strict adherence to stop-loss levels can significantly improve long-term outcomes.

As a general rule, no more than two trades should be taken in a single session. Ideally, this should include a combination of one range-based trade and one momentum-based trade. If the first trade of the day achieves its intended target, it is often prudent to avoid further trades and preserve capital.

Such structured discipline helps in reducing emotional trading, minimizing drawdowns, and building long-term consistency.

Stock of the Day for Tuesday, 17 February 2026: ICICI Lombard

For the next trading session, ICICI Lombard General Insurance appears technically well-positioned on the daily chart structure. The stock is exhibiting signs of strength, supported by favorable trend alignment and improving momentum.

A buying approach near the current market price of around 1,922 may be considered, with a protective stop-loss placed near 1,900. The first upside objective lies near 1,965. This setup offers a balanced risk-reward structure, and the broader chart pattern indicates potential for further upside if momentum sustains.

As always, traders should evaluate their risk tolerance, position sizing, and overall portfolio exposure before entering any trade.

Global and Geopolitical Developments: Impact on Market Sentiment (Last 24 Hours)

Over the last 24 hours, global markets have been influenced by several important developments.

Fresh inflation data from the United States indicated a gradual cooling of price pressures, strengthening expectations of potential interest rate reductions by the Federal Reserve later in 2026. This development has provided positive momentum across global equity, bond, and commodity markets.

Crude oil prices moved higher following renewed geopolitical tensions in the Red Sea region. Reports of fresh attacks on commercial vessels raised concerns over supply disruptions, adding risk premium to energy markets.

In India, January CPI inflation data came in below market expectations. This has revived optimism regarding a possible shift toward a more accommodative monetary stance by the Reserve Bank of India, supporting equity and bond market sentiment.

China announced fresh liquidity and targeted credit measures aimed at stabilizing its slowing economy. These steps are expected to support industrial demand, property sector stability, and overall economic growth, with positive implications for global commodities and emerging markets.

Meanwhile, geopolitical tensions in Eastern Europe intensified after renewed strikes on Ukraine’s energy infrastructure. These developments have kept energy security concerns elevated, particularly across European markets.

Final Thoughts: Market Outlook and Trading Approach

Monday’s session delivered a strong technical recovery for Nifty, indicating a renewed attempt by bulls to regain control. However, weak market breadth and ongoing global uncertainties suggest that traders should remain selective, disciplined, and risk-aware.

The coming session will be crucial in determining whether the recovery evolves into a sustained trend or remains a short-term technical rebound. Adopting a structured strategy, maintaining emotional control, and prioritizing capital preservation should remain the core focus for traders.

MarkShala – Call to Action

Loved this analysis? Stay ahead in the markets with Markshala’s expert insights. Get deeper market research, trade setups, and investing guidance delivered straight to your inbox.

👉 For collaborations & queries: somnath@markshala.com

👉 WhatsApp Connect: +91 8209177236

Looking to invest in current NFOs or Bonds?

👉 Explore live investment opportunities here: Click Here

Click Here to join our partner Equity / Other Capital Market Investing Platform and unlock MarketShala’s expert-backed investing guidance. You may also join our WhatsApp community MarketShalians to stay tuned with regular updates in your wealth creation journey.

Click Here to join our partner in Crypto Currency Market Investing Platform and unlock MarketShala’s expert-backed investing guidance.

Stay informed. Stay profitable.

– Team Markshala

Disclaimer

The views and analysis provided above are for educational and informational purposes only and should not be considered as financial or investment advice. Trading and investing in the stock market involve risk, and past performance does not guarantee future results.

***********

|| ॐ नमः शिवाय ||