By Somnath Das | www.markshala.com

Market Overview: Momentum Defines Intraday Trading

For an intraday trader, the direction of the market is far less important than the presence of momentum. Whether the market moves up or down, what truly matters is the availability of a clean and directional move that can be captured with discipline. Friday’s market session turned out to be a textbook example of how momentum-based trading setups can offer excellent opportunities.

In our previous analysis, three important support levels in Nifty Futures were highlighted at 25,820, 25,760, and 25,708. Due to weak global cues and negative overnight handovers from international markets, Nifty Futures opened with a sharp gap-down, breaking below all three levels at the start of the session.

This gap-down opening immediately changed the market structure. The 25,760 zone, which had earlier acted as support, transformed into a strong resistance level. This shift created a clear short-selling opportunity. Traders who entered short positions near this level witnessed a sharp and swift decline of nearly 190 points within a short span of time.

The overall intraday range expanded to 238 points, while from the previous session’s close, Nifty Futures displayed a total movement of 369 points. The market maintained a one-sided directional trend throughout the session, making it one of the cleanest intraday trading environments seen in recent times. Such setups are ideal for momentum traders, as they provide clarity, speed, and low noise.

Market Closing Summary: Sentiment Takes a Hit

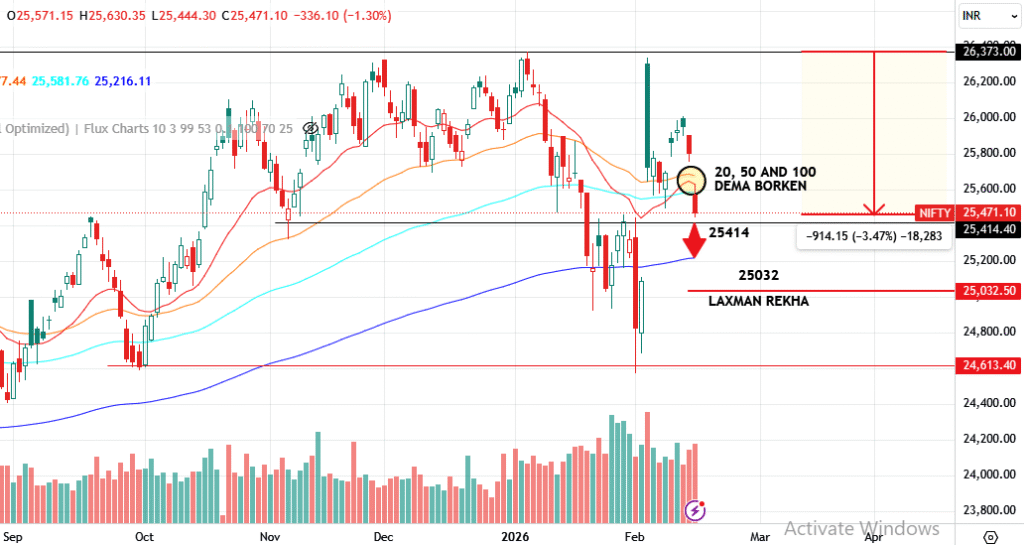

Friday’s session ended on a weak note, with selling pressure visible across sectors and market capitalizations. Nifty Spot closed at 25,471, registering a decline of 1.30 percent. Market breadth remained extremely negative, with only 637 stocks closing in the green compared to 2,272 stocks ending in the red.

While it would be premature to declare a long-term trend reversal, the market structure has clearly deteriorated. This structural weakness has impacted investor sentiment, making the session emotionally difficult for many market participants.

For investors, such phases often test patience. Prolonged periods of market correction create discomfort and uncertainty. However, history suggests that disciplined investors who maintain patience and avoid panic selling are often rewarded when markets stabilize and recover.

This is a phase where leverage-based speculation must be avoided. Instead, systematic investments in fundamentally strong companies or diversified index instruments offer a more prudent approach. Global uncertainties, geopolitical risks, and rapid technological disruptions are currently generating fear across financial markets. In such environments, controlled and disciplined accumulation, without leverage, tends to be the most sensible strategy.

Technical Structure: Support Zones and Risk Levels

From a technical perspective, Nifty Spot is currently trading around 3.47 percent below its lifetime highs. However, the actual damage in individual portfolios feels significantly higher due to broader market weakness.

One important technical observation is that Nifty Spot breached its 20-day, 50-day, and 100-day moving averages in a single trading session. This breakdown indicates a shift toward short-term bearish structure and signals caution.

Immediate support for the index is visible near 25,414. If this level fails to hold, the next major support emerges near the 200-day moving average, which is positioned around 25,216. This zone is expected to act as a crucial decision-making area for market participants. The opening and early price action on Monday will therefore play a vital role in determining short-term market direction.

Nifty Futures Trading Strategy for Monday, 16 February 2026

Given the sharp rise in volatility and the expansion in daily trading ranges, traders should approach Monday’s session with patience and discipline. The key focus should remain on clarity rather than frequency of trades.

The intraday consolidation range for Nifty Futures stands between 25,684 and 25,290. If the market opens within this zone, traders may consider adopting a range-based strategy. Short positions can be considered near the upper boundary of 25,684, while long trades may be evaluated near the lower boundary of 25,290. In both scenarios, a stop loss of 50 points and a target of 100 points should be maintained to preserve a favorable risk-to-reward structure.

If Nifty Futures manages to move decisively above 25,684, bullish momentum could activate. In such a case, upside resistance levels are likely to emerge near 25,743 and 25,965. For this momentum setup, traders should maintain a disciplined stop loss of 50 points and aim for a minimum target of 100 points.

On the other hand, if Nifty Futures breaks below 25,290 with sustained selling pressure, bearish momentum may resume. The next visible support then lies near 25,119. Similar risk management rules should apply, with a stop loss of 50 points and a target of at least 100 points.

Trading Discipline and Risk Management

One of the most overlooked aspects of trading success is limiting the number of trades. Overtrading often leads to emotional decision-making and capital erosion.

As a discipline-based approach, traders should restrict themselves to a maximum of two trades per day. Ideally, this should involve one range-based trade and one momentum-based trade. If the first trade itself reaches its target, it is advisable to stop trading for the day. Preserving capital and emotional stability is far more important than chasing every market move.

Stock of the Day: Campus Activewear Ltd

For Monday, 16 February 2026, Campus Activewear Ltd emerges as the Stock of the Day based on its technical structure and favorable price behavior.

The stock is displaying improving momentum and stable price formation on the charts. The risk-to-reward ratio for the setup stands close to 1:2.28, making it an attractive positional opportunity.

The buying zone is around the current market price of ₹272. A positional stop loss should be placed near ₹268, while the target is projected near ₹282. This trade setup balances risk and potential reward effectively, aligning with disciplined trading principles.

Key Global and Indian Geopolitical Developments in the Last 24 Hours

Global events continue to play a critical role in shaping market sentiment. Over the past 24 hours, several developments have influenced economic outlook and investor confidence.

India conducted a significant bond switch operation involving ₹75,500 crore of FY27 bonds, exchanging them with longer maturity bonds due in 2040. This move aims to reduce near-term repayment pressure and stabilize bond market yields, supporting fiscal management and banking sector liquidity.

Meanwhile, global oil markets tightened as geopolitical tensions involving Russia, Iran, and the Middle East affected supply expectations. Brent crude prices moved closer to the $70 per barrel mark, raising concerns about inflation and India’s trade balance.

The United Kingdom announced fresh military aid of £540 million to Ukraine, escalating geopolitical risks in the region. Such developments tend to increase global market volatility, particularly impacting energy, metals, and defense-related sectors.

In India, a nationwide Bharat Bandh led by multiple trade unions and farmers’ groups disrupted economic activity across more than 600 districts. Transport services, logistics operations, and business activities were affected, leading to short-term economic disruptions.

On a positive macroeconomic note, India’s Consumer Price Inflation for January cooled to 2.75 percent under the revised inflation methodology. This softer inflation reading strengthens expectations of monetary policy easing and improved liquidity conditions, which could support equity markets over the medium term.

Final Thoughts

The Indian stock market is currently navigating a complex environment marked by global uncertainties, geopolitical risks, and technical weakness. For traders, disciplined momentum-based strategies remain the most effective approach. For long-term investors, patience, quality selection, and systematic investing continue to be the cornerstone of wealth creation.

Volatile phases often sow the seeds of future opportunities. Staying disciplined, informed, and emotionally balanced is the key to navigating such market cycles successfully.

MarkShala – Call to Action

Loved this analysis? Stay ahead in the markets with Markshala’s expert insights. Get deeper market research, trade setups, and investing guidance delivered straight to your inbox.

👉 For collaborations & queries: somnath@markshala.com

👉 WhatsApp Connect: +91 8209177236

Looking to invest in current NFOs or Bonds?

👉 Explore live investment opportunities here: Click Here

Click Here to join our partner Equity / Other Capital Market Investing Platform and unlock MarketShala’s expert-backed investing guidance. You may also join our WhatsApp community MarketShalians to stay tuned with regular updates in your wealth creation journey.

Click Here to join our partner in Crypto Currency Market Investing Platform and unlock MarketShala’s expert-backed investing guidance.

Stay informed. Stay profitable.

– Team Markshala

Disclaimer

The views and analysis provided above are for educational and informational purposes only and should not be considered as financial or investment advice. Trading and investing in the stock market involve risk, and past performance does not guarantee future results.

***********

|| ॐ नमः शिवाय ||