Bitcoin Weekly Analysis & Price Prediction: Practical Trading and Investment Strategy for the Coming Week

Bitcoin (BTCUSD) is currently at a critical junction on the weekly chart. After an extended rally that pushed prices close to the psychological $100,000 level, the market has entered a consolidation phase. This phase is extremely important—not just for traders looking for short-term opportunities, but also for long-term investors planning strategic accumulation.

In this blog, we combine technical analysis, fundamental insights, and real-world trading logic to help you understand what Bitcoin is likely to do next and how you can plan your trades and investments accordingly.

Bitcoin Price Today: Weekly Market Overview

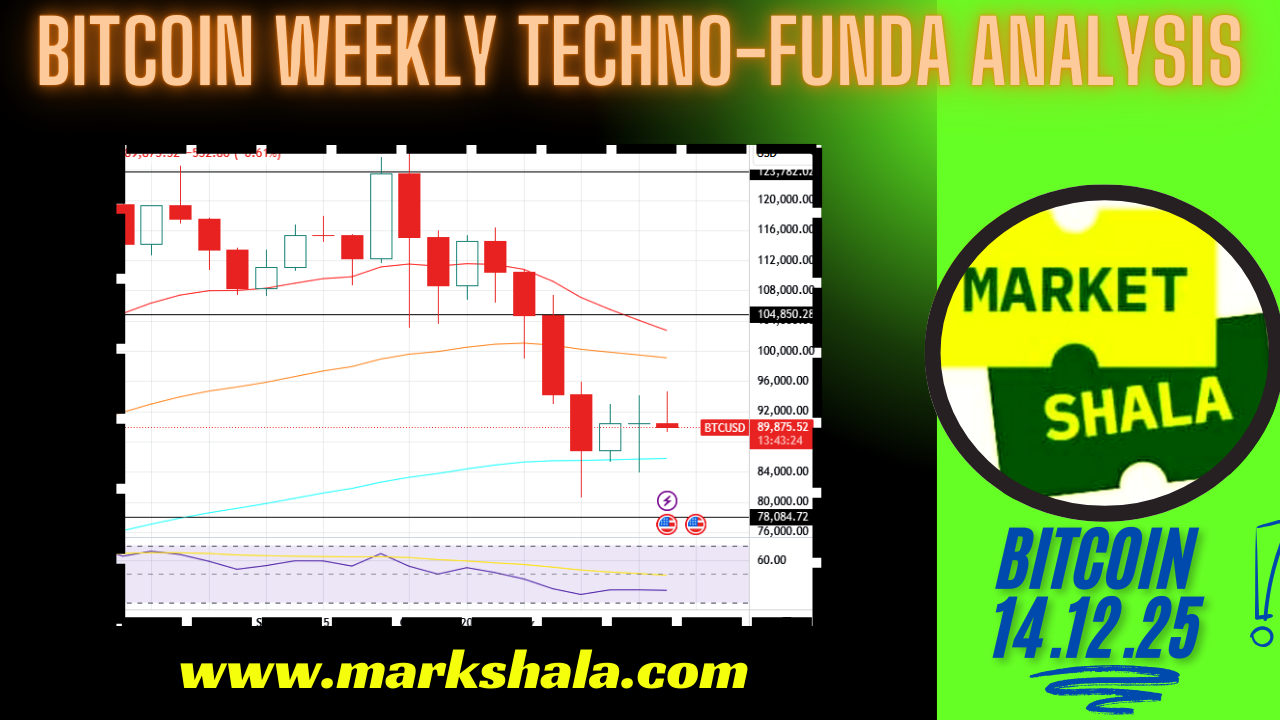

As of the latest weekly close, Bitcoin is trading near $89,000–$90,000, reflecting a controlled correction rather than panic selling. This price action indicates that the market is digesting previous gains and waiting for the next macro trigger.

📌 Key Insight:

A sideways or corrective move after a strong rally is a healthy market behavior, especially on higher timeframes like the weekly chart.

Bitcoin Weekly Technical Analysis (BTCUSD)

Long-Term Trend Analysis

- Bitcoin continues to trade above its 100-week and 200-week moving averages, confirming that the long-term trend remains bullish.

- Short-term moving averages (20 & 50 EMA) are flattening, suggesting loss of momentum, not trend reversal.

- The weekly RSI is moving toward the neutral zone, which typically signals consolidation before the next big move.

📈 What This Means:

The market is pausing, not collapsing. Smart money usually accumulates during such phases.

Key Support and Resistance Levels for Bitcoin

Understanding support and resistance is essential for planning real trades.

Major Resistance Levels

- $95,000 – $97,000: Immediate selling pressure

- $100,000 – $104,000: Strong psychological and technical resistance

- A weekly close above this zone may open the door for fresh upside momentum

Major Support Levels

- $88,000 – $90,000: Current demand zone

- $78,000 – $80,000: Strong weekly support and previous breakout area

- $70,000: Long-term structural support (only relevant during extreme selling)

📌 Trading Wisdom:

Strong trends rarely reverse without breaking major weekly supports.

Bitcoin Trading Strategy for the Coming Week

Bullish Trade Setup (Swing & Positional Traders)

Best suited for: Low-risk, confirmation-based traders

- Buy Zone: $90,000 – $92,000 (only if price stabilizes)

- Breakout Buy: Weekly close above $95,000

- Targets:

- Target 1: $100,000

- Target 2: $104,000

- Stop-Loss: $85,500

👉 Avoid aggressive buying near resistance without confirmation.

Bearish Trade Setup (High-Risk Strategy)

Best suited for: Experienced traders only

- Sell Trigger: Weekly close below $88,000

- Targets:

- Target 1: $80,000

- Target 2: $70,000

- Stop-Loss: $92,500

📌 Risk Reminder:

Shorting Bitcoin without confirmation can be extremely dangerous in a bullish macro cycle.

Bitcoin Investment Strategy: What Long-Term Investors Should Do

If you are investing in Bitcoin for the long term, this phase should be viewed as an opportunity, not a threat.

Smart Bitcoin Investment Approach

- Avoid lump-sum buying near $100,000

- Consider staggered accumulation near $80,000–$85,000

- Keep cash reserves for deeper corrections

- Focus on long-term adoption trends, not daily price noise

📌 Golden Rule:

“Wealth is created during corrections, not during hype.”

Weekly Bitcoin Fundamental Updates

Positive Fundamental Factors

- Continued institutional inflows through Bitcoin ETFs

- Growing corporate interest in Bitcoin as a balance-sheet asset

- Fixed supply post-halving supporting long-term valuation

Short-Term Headwinds

- Global equity market volatility

- Uncertainty around interest rate cuts

- Profit booking after a strong rally

📌 Fundamental Insight:

Bitcoin is currently more influenced by macro liquidity and risk sentiment than crypto-specific news.

Bitcoin Market Sentiment & Psychology

The market is currently in a neutral sentiment phase:

- Bulls are cautious

- Bears are selective

- Long-term investors remain confident

Such phases often precede strong directional moves once a range is broken.

Bitcoin Price Prediction: What to Expect Next?

- Bullish Scenario: Weekly close above $95,000 → move toward $100k–$104k

- Sideways Scenario: Range between $88k–$95k

- Bearish Scenario: Weekly close below $88,000 → $80k or lower

📊 Overall Bias: Neutral to mildly bullish, unless $78,000 breaks decisively.

Final Thoughts: How to Trade and Invest in Bitcoin Right Now

- Traders should focus on confirmation-based setups

- Investors should focus on patience and disciplined accumulation

- Emotional decisions should be avoided at all costs

Bitcoin remains a long-term structural bull, but short-term discipline is essential.

MarketShala

Loved this analysis? Stay ahead in the markets with Markshala’s expert insights.

Get deeper market research, trade setups, and investing guidance delivered straight to your inbox.

👉 For collaborations & queries: somnath@markshala.com

👉 WhatsApp Connect: +91 8209177236

Click Here to join our partner Equity / Other Capital Market Investing Platform and unlock MarketShala’s expert-backed investing guidance. You may also join our WhatsApp community MarketShalians to stay tuned with regular updates in your wealth creation journey.

Stay informed. Stay profitable.

– Team Markshala

Disclaimer

The views and analysis provided above are for educational and informational purposes only and should not be considered as financial or investment advice. Trading and investing in the stock market involve risk, and past performance does not guarantee future results.

***********

|| ॐ नमः शिवाय ||