Hello MarketShalians, Welcome to our weekly market wrap of Indian and World Market FinDose Blog. It is an strange atmosphere, world markets are achieving new highs and then there is us, i.e. the Indian market, who are busy watching how much the FIIs sold today. The Indian market is seen doing business opposite to the world markets. Blaming the FIIs is a very easy job as an investor of the Indian market. But looking within oneself is an important way which we must do as an Indian investor. Are majority of our businesses able to show corporate earnings above the mark, NO, this is the second back to back quarter when this is not happening. Is the valuation of our market cheaper than other emerging markets, the answer is NO and the solution is that businesses will have to show earnings to deserve high valuations.

Dollar is strengthening. The vision and policies of US President Donald Trump are giving US investors an opportunity of better returns in their own country. Then why should FIIs not sell to Indian markets, this is today’s truth. But as soon as the performance of our corporate is visible again, FIIs will also surely come back to invest in India. The Indian Central Government budget is to be released in the coming week and all eyes are on it that how the government can boost the equity markets with its budget and this is the only hope being shown to the Indian markets in the near future. So whatever happens, we will discuss that too, for now let’s take a deep dive into the action of the last week and what else is hidden in the womb of the coming week. Let’s start.

Table of Contents

US Markets

We consider to measure world market sentiments with the Dowjones. As in last week, the Dowjones had given indications that it is going to be strengthen. A nice bullish engulfing was formed on the weekly charts and see, the Dowjone managed to close this week with a gain of 2.15%. You can see similar performance in Nasdaq, S&P500, European markets as well. All of them traded in an excellent manner this week.

The weekly chart of Dowjones is showing that it will be seen showing strength in the coming week as well. Having reached almost near of its lifetime highs, the Dowjones has now closed this week at 44424 and closed with a gain of 2.15%, gaining 936 points on a week-on-week basis. Here, US President Donald Trump has given a statement about talking to the FED Chair J. Powell for reducing the interest rates, which may seem to enhance the liquidity in the US economy in the coming times, and we know that Donald Trump can do anything.

Dowjones’s sentiment will remain strong in the coming week and our readers who have the ability to trade Dowjones should adopt the strategy of staying on the long side.

Respective Levels will be as follows:

Support – 43173, 41868, 41565

Resistance – 44962, 47395

Sentiment – Strong

India Market

Nifty Outlook and Trade Probability

Nifty continued its downtrend this week as well and showed a fall of 0.48% and -111 points. Nifty is formed near its lower levels of -12.54% from the peak. Nifty has definitely lost a little week to week but when you look at the weekly chart, it also appears as a consolidation phase. The budget event in the coming week can create a make or break situation for the coming week.

Currently, the weekly charts of Nifty are showing weakness, due to which it can be beneficial to follow the short side trading strategy of sell on rise or in case the below mentioned support level is breached in the coming week. There is an upcoming annual budget event so it is important to be a little cautious.

Respective Levels will be as follows:

Support – 23286, 23428-460, 23644

Resistance – 23088, 22975, 23593, 21881

Sentiment – Weak

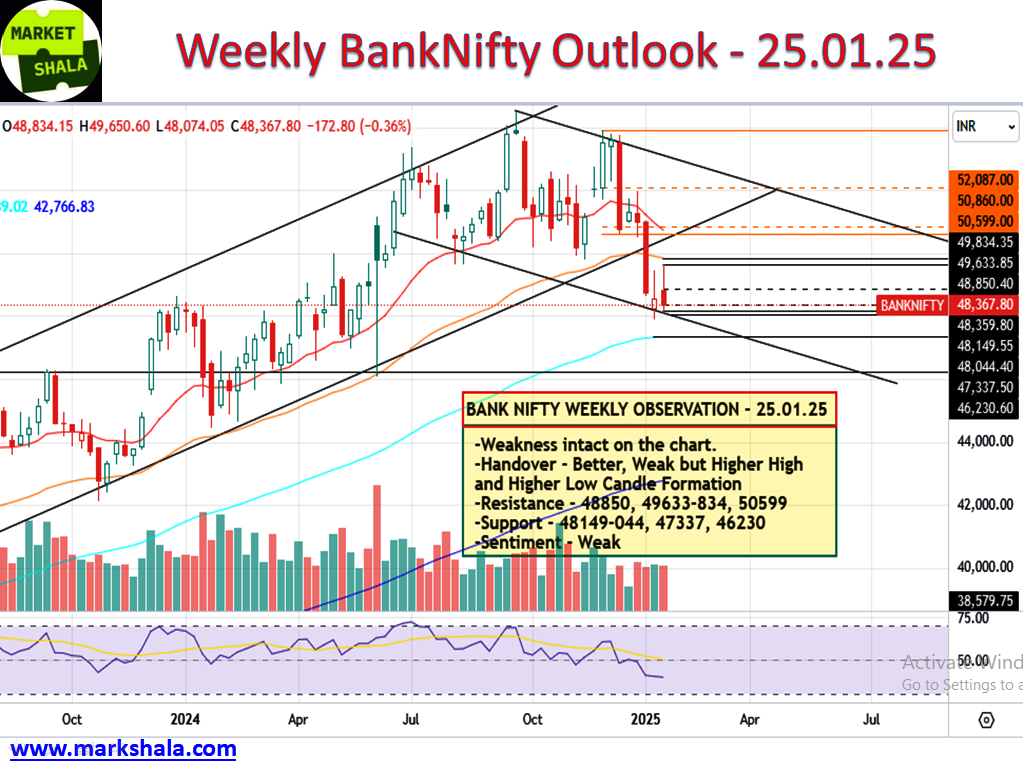

BankNifty Outlook and Trade Probability

BankNifty witnessed weakness this week and registered closing with a fall of -0.46% and -172 points. Weakness is still being seen on the weekly chart. Only one positive thing was seen in this week’s candles, despite closing with a fall, the weekly candle moved higher and formed a higher low which is a slight positive signal. Second slight positive is that BankNifty is trading close to the lower band of its downtrend channel. Overall market sentiment is weak. For the coming week trading strategy should be sell on rise. Whenever the support levels given below are breached or it comes near the resistance levels, then trading with short bias can be a right strategy for the coming week.

Respective Levels will be as follows:

Support – 48850, 49633-834, 50599

Resistance – 48149-044, 47337, 46230

Sentiment – Weak

Stock of the week (Long/Short)

Long Side Trade: This week FIVESTAR is coming in our setup where we will initiate the LONG side trade. Levels and Chart image is from the cash levels and it needs to be converted into the future levels if the position is being made in FnO. And if it is not available in FnO then trade will be considered in the spot levels only.

Buy at the CMP / 703.00, Stop Loss at 660.00, Target at 806.00 with a Risk Reward Ratio of 1:2.25

Short Side Trade: This week ZYDUSLIFE is coming in our setup where we will initiate the SHORT side trade. Levels and Chart image is from the cash levels and it needs to be converted into the future levels.

Sell at the CMP/957.00, Stop Loss at 994.00, Target at 882.00 with a Risk Reward Ratio of 1:2

Alternative Investments

Gold Outlook and Trade Probability

Gold has seen a gain of 2.51% this week continuing the bullish sentiments this week. Bullish momentum is expected to be seen in Gold next week as well. Gold trading strategy for next week should be done with a long side bias. Last week Gold has closed at its lifetime highs and it is on big bullish sign which is showing on the weekly chart.

Respective Levels will be as follows:

Support – $2748, $2716, $2691, $2660

Resistance – $2785, $2872Sentiment – Strong

Silver Outlook and Trade Probability

As compare to the last week a better candle formation was seen in Silver. A higher high and higher low formation was seen. Silver saw an increase of 0.64%. Silver is seeing a slow and steady up-move since last 4-5 weeks after a big fall from its peak. A new uptrend channel is seen forming on the weekly chart. The current price is now seen near the lower band of the uptrend channel which is showing the availability of a good risk and reward for the long side trades.

A strategy to trade on the long side in silver should be planned for the coming week. If the lower band is breached along with a day close then the trading bias may also have to be switched towards the short side momentum.

Respective Levels will be as follows:

Support – $30.37, $30.03, $29.65, $29.07

Resistance – $31.08, $33.79, $34.87, $35.20

Sentiment – Neutral with Positive Bias

Crude Oil (WTI) Outlook and Trade Probability

Crude oil is seen coming under the control of bears on the weekly charts. Last time we saw Gravestone Dozi candle formation which was a bearish pattern and now a 3 candle formation is visible on the chart which is called Evening Star. It is a strong reversal indication towards downside on the charts. This week WTI Crude showed a decline of -3.62%. The sentiment of Crude seems weak and hence one should trade with a sell on rise strategy for next week. If the levels of $73.43 are broken on daily closing basis then Crude can go to test its old base level of $66.47.

Respective Levels will be as follows:

Support – $74, $73.43, $66.47

Resistance – $74.95, $76.30, $77.82, $80.78

Sentiment – Weak

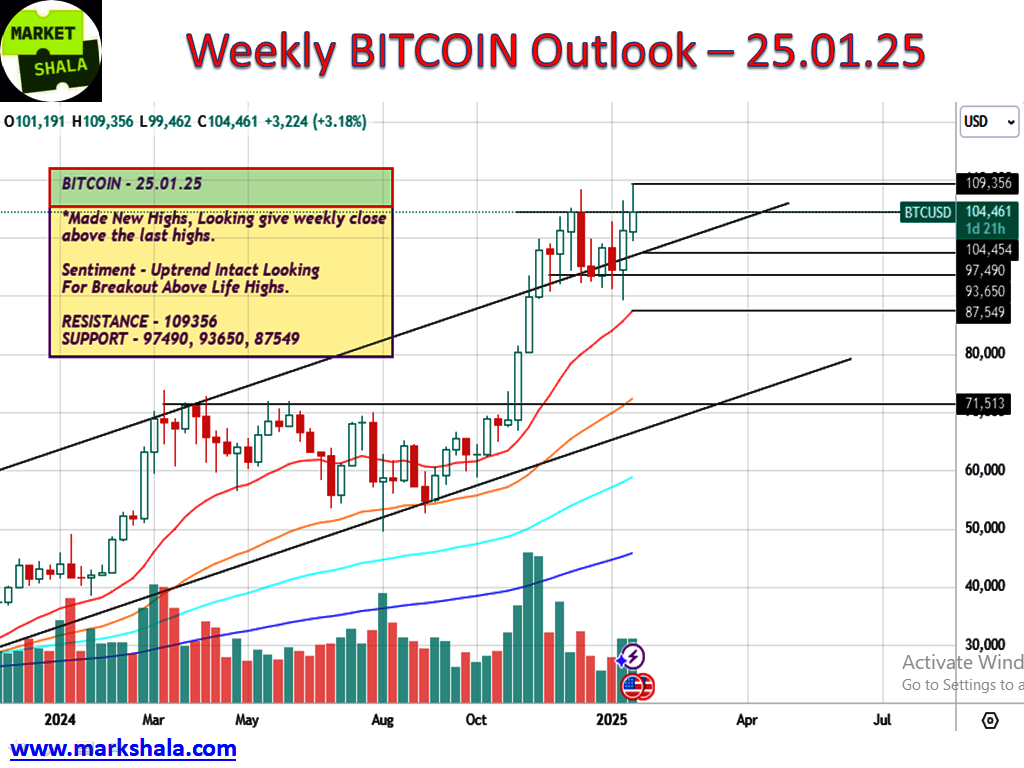

Bitcoin Outlook and Trade Probability

This week we saw Bitcoin making a new high and this is a positive signal showing how strong the demand is for this asset class in the world market. Therefore, while looking at the price and action, as we do every time, we will advise not to short Bitcoin. Bitcoin has not only touched new life highs on the weekly charts but has also succeeded in giving a life high weekly close. This indication seems to be strengthening the possibilities of future growth of Bitcoin. Only one strategy seems to be working in Bitcoin and that is to accumulate whenever it comes near the support levels and accumulate again whenever it breaks the resistances, but never think of shorting Bitcoin in 2025.

Respective Levels will be as follows:

Support – $97490, $93650, $87549

Resistance – $109356

Sentiment – Strong

Conclusion and disclaimer

The content on MarkShala.com is intended for educational and informational purposes only. We specialize in writing blogs on financial planning, investment strategies, economic trends, and related topics. While we strive to provide accurate and reliable information, the content should not be taken as professional financial, investment, or legal advice.

हिंदी अनुवाद

यहां क्लिक करें और हिंदी दर्शक इस विषय पर मेरा यूट्यूब वीडियो देख सकते हैं।

How did you like our blog? Do share your thoughts in the comment box. Your thoughts will inspire us to bring more good and relevant content for you so that we can enhance the quality of our content and you can benefit more.

Thank you for tuning in to MarketShala’s Fin Dose — your essential source for insights into the financial markets, India and global economy, Don’t forget to share this story on your network.

Explore More on MarketShala

Stay updated with insights on global events, market analysis, and investment strategies on Markshala, where we aim to make financial education accessible and actionable. Now, let’s shift gears and unwind! Treat yourself to the soothing tunes of MuziMuffin with his latest release available on Spotify, YouTube and Apple Music. Relax, recharge, and enjoy the vibe!

***********

|| ॐ नमः शिवाय ||