Introduction: Why This Bitcoin Phase Matters More Than Headlines

Bitcoin is currently at a critical decision point, where short-term volatility is testing patience while long-term fundamentals remain constructive. This is the kind of market phase where real money is made quietly, not emotionally.

This article focuses on actionable trade setups, risk-managed investment strategies, and a clear monthly Bitcoin investment roadmap, so readers know exactly what to do—not just what to expect.

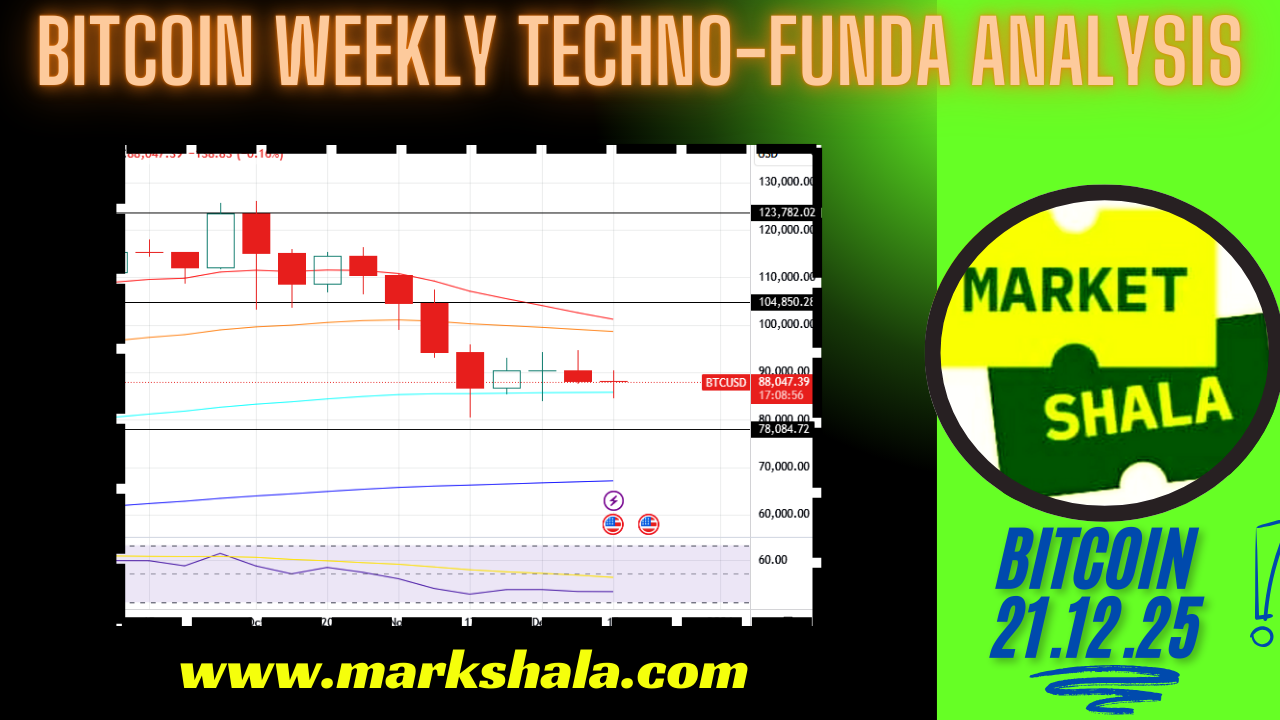

Bitcoin Weekly Chart Overview (Big Picture First)

On the weekly timeframe, Bitcoin remains in a structural uptrend, even though price momentum has cooled.

Key Weekly Observations

- BTC has slipped below the 20-week EMA, indicating short-term weakness.

- Price is testing the 50-week EMA, a crucial trend-deciding level.

- The 100-week and 200-week EMAs remain far below, confirming long-term bullish structure.

📌 Interpretation:

This is a correction within a bull market, not a trend reversal.

Key Support & Resistance Levels (Weekly)

Important Support Zones

- 88,000 – 85,500: Immediate weekly support zone

- 78,000 – 80,000: Strong demand and previous breakout area

- 67,000 – 70,000: Long-term structural support

Major Resistance Zones

- 95,000 – 98,000: Short-term supply zone

- 104,000 – 110,000: Strong breakout resistance

- 123,000+: Psychological and historical resistance

RSI & Momentum Insight (What Indicators Are Really Saying)

- Weekly RSI is near oversold territory, but without panic signals.

- Selling pressure is gradually weakening.

- Momentum suggests base formation or relief rally, not aggressive downside.

📌 This is not an ideal zone for fresh shorts, but a zone for selective accumulation and patient trades.

Practical Bitcoin Trade Strategy for the Coming Week

✅ Buy-on-Dip Strategy (High-Probability Setup)

Who should use this:

Swing traders and positional traders (1–3 weeks)

Buy Zone:

👉 86,500 – 88,500 (scale in gradually)

Stop Loss:

🛑 Weekly close below 82,800

Targets:

🎯 Target 1: 95,000

🎯 Target 2: 104,000

📌 Best practice: Divide capital into multiple entries instead of a single buy.

❌ Sell / Short Strategy (Confirmation-Based Only)

Trigger Condition:

👉 Weekly close below 82,800

Targets:

🎯 78,000

🎯 72,000

Stop Loss:

🛑 88,500

⚠️ Counter-trend trade — strict position sizing required.

Bitcoin Fundamentals: Weekly Updates That Matter

1️⃣ Institutional Demand Still Intact

Spot Bitcoin ETFs continue to absorb supply during dips. Institutions are accumulating weakness, not chasing strength.

2️⃣ Post-Halving Cycle Supports Higher Prices

Historically, Bitcoin:

- Consolidates after halving

- Breaks out strongly 6–12 months later

Current price action aligns well with this historical behavior.

3️⃣ Macro Environment Favors Bitcoin

- Rate cut expectations in 2025

- Weakening USD supports risk assets

- Bitcoin increasingly treated as digital macro hedge

Monthly Bitcoin Investment Roadmap (Practical & Realistic)

🔹 Month 1: Base Formation Phase

Strategy: Accumulate gradually

Action:

- Buy small quantities near 85k–88k

- Keep cash ready for volatility

- Avoid leverage

🔹 Month 2: Volatility Expansion Phase

Strategy: Confirmation-based allocation

Action:

- Add exposure if BTC holds above 95k

- Trail stop losses on short-term trades

- Avoid panic selling on dips

🔹 Month 3: Breakout or Deeper Correction Phase

Two Scenarios:

✔️ Bullish Breakout:

- Add on breakout above 104k

- Hold core positions

- Partial profit booking near ATH zones

❌ Deeper Correction:

- Accumulate aggressively between 70k–75k

- Focus on long-term holding

- Ignore short-term noise

Risk Factors to Monitor Closely

- Weekly close below 82,800

- Sharp ETF outflows

- Global equity market correction

- Sudden regulatory actions

Final Verdict: Bitcoin Weekly & Monthly Outlook

| Timeframe | Bias |

| Short-Term | Neutral to Mild Bullish |

| Medium-Term | Bullish |

| Long-Term | Strongly Bullish |

📌 Strategy Summary:

- Buy dips, not hype

- Trade only with confirmation

- Invest gradually, not emotionally

- Risk management > predictions

Bitcoin is not weak — it is preparing.

MarketShala

Loved this analysis? Stay ahead in the markets with Markshala’s expert insights.

Get deeper market research, trade setups, and investing guidance delivered straight to your inbox.

👉 For collaborations & queries: somnath@markshala.com

👉 WhatsApp Connect: +91 8209177236

Click Here to join our partner Equity / Other Capital Market Investing Platform and unlock MarketShala’s expert-backed investing guidance. You may also join our WhatsApp community MarketShalians to stay tuned with regular updates in your wealth creation journey.

Click Here to join our partner in Crypto Currency Market Investing Platform and unlock MarketShala’s expert-backed investing guidance.

Stay informed. Stay profitable.

– Team Markshala

Disclaimer

The views and analysis provided above are for educational and informational purposes only and should not be considered as financial or investment advice. Trading and investing in the stock market involve risk, and past performance does not guarantee future results.

***********

|| ॐ नमः शिवाय ||