Hello MarketShalians, Welcome to explore today’s Global Market Pulse India Trading Insights at MarketShala. Let us take a look at what major buzz related to the economic actions and trading levels are taking place in the country and the world and what impact they are going to have.

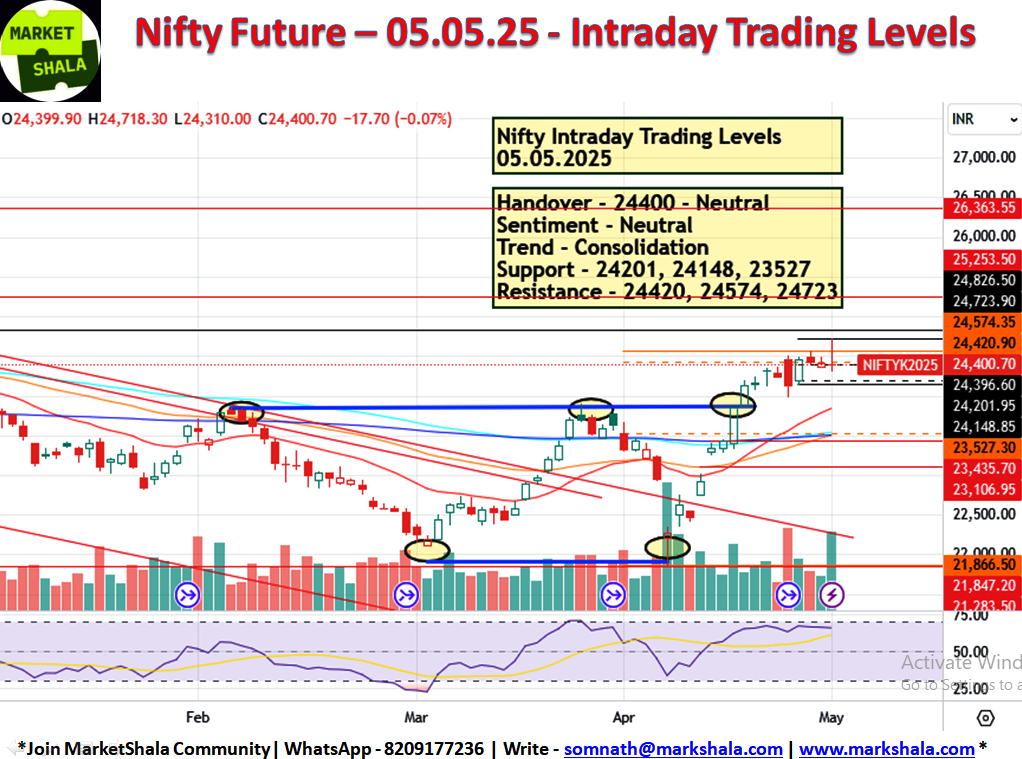

Nifty Trading Setup and Levels

If we look at the weekly closing of Nifty Future, we will see gains of around 1 percent, which sounds quite reasonable but if we look at the broad markets, some pressure is visible. An atmosphere of uncertainty and high volatility is prevailing in the markets. The daily closing Nifty Future charts are not showing strength; a phase of consolidation has been continuing since last week. However, the sentiment of world markets and handover both are looking strong, reflection of which is visible on Gift Nifty as well. So as I said in the last analysis that this market condition is not one to trade with a one way bias, this is a battle field for a smart trader where you would have to maintain a smart trading approach on both sides until the markets do not show any inclination in one direction whether it is up or down.

The levels given below would prove to be beneficial for trading Nifty Future.

Nifty Intraday Trading Levels – 05.05.2025

Handover – 24400 – Neutral

Sentiment – Neutral

Trend – Consolidation

Support – 24201, 24148, 23527

Resistance – 24420, 24574, 24723

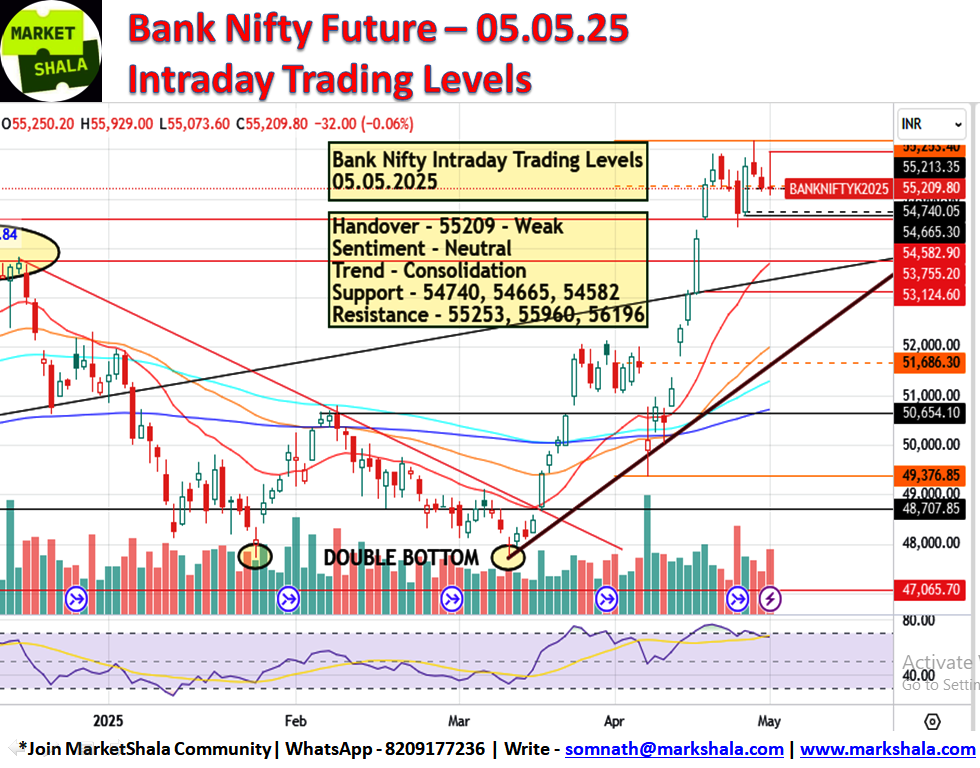

Bank Nifty Trading Setup and Levels

Bank Nifty also closed with a gain of .89 percent but a bearish candle formation is visible on the daily chart. On the other hand, if you look, Bank Nifty is not ready to give a downside breakout despite many efforts. Bank Nifty is seen consolidating in the range of 600-700 points since last one week. Hence, it would not be safe to implement any pre-decided approach in your trade. The surge seen in Bank Nifty and the formation of a consolidation phase near new highs is a healthy sign but a trader needs to respect the price and action on the charts to achieve his short term goals rather than forming trading positions with any assumptions. Bank Nifty will also have to create opportunities to trade on both sides near the below given levels. The below given levels will prove to be beneficial for trading Bank Nifty Futures.

Bank Nifty Intraday Trading Levels – 05.05.2025

Handover – 55209 – Weak

Sentiment – Neutral

Trend – Consolidation

Support – 54740, 54665, 54582

Resistance – 55253, 55960, 56196

Stock of the day – 05.05.2025

The stock trading idea of tomorrow i.e. 05.04.25 UBL has come out on our setup. A good rounding bottom is visible on its daily charts and after that selling pressure is seen being generated. Now UBL price and action is seen moving towards a handle formation. Keeping in mind the nearby support and resistance, a positional trade can be initiated on UBL as per the levels given below.

Stock of the day – 05.05.25

Stock – UBL

Buy at CMP/2164

Stop Loss at 2104

Target at 2289

RRR at 1:2.12

Global Market Shifts: U.S. Pushes to Delist Chinese Firms, TikTok Fined, Bezos Sells Amazon Shares

A group of U.S. lawmakers has called on the Securities and Exchange Commission (SEC) to remove Alibaba and other Chinese firms from American stock exchanges, citing concerns over transparency and national security. Canadian Prime Minister Mark Carney said he will meet President Trump in Washington on Tuesday. Carney said the talks will focus on near-term trade pressures and broader economic prospects. The newly elected leader said it is important to engage with the White House immediately. TikTok has been hit with a hefty €530 million fine by European regulators for illegally transferring user data from the EU to China, raising serious concerns over data privacy and security compliance. Jeff Bezos to sell up to $4.75 billion worth of Amazon shares.

U.S. Adds 177,000 Jobs in April, Beats Forecasts Despite Slower Growth and Flat Unemployment Rate

In April, the U.S. economy saw an increase of 177,000 jobs, as reported by the Bureau of Labor Statistics in its latest update. That’s more than economists forecast, but less than the previous month. The government has revised its earlier estimate for March job growth, reducing the figure from 228,000 to 185,000, while also making minor adjustments to the February data. The unemployment rate remained unchanged at 4.2% in April. The BLS noted that the rate “has remained in a narrow range of 4.0% to 4.2% through May 2024.” Economists had anticipated that the U.S. economy would add around 135,000 jobs in April, a noticeable drop from the initially reported 228,000 in March. They also expected the unemployment rate to hold steady at 4.2%. However, the latest figures show that 177,000 jobs were actually created in April, surpassing expectations and easing worries about the initial effects of President Donald Trump’s economic policies on the country. Friday’s data from the Bureau of Labor Statistics was higher than the 135,000 expected by economists surveyed by Bloomberg. But it is lower than March’s revised figure of 185,000 positions. The unemployment rate remained unchanged at 4.2 percent. Official data this week indicated the first fall in GDP in three years, but was distorted by a surge in imports ahead of Donald Trump’s trade tariffs, while domestic demand remains strong.

Bank of Japan Cuts Growth Outlook for 2025–26, Signals Caution on Rate Hikes Amid Trade Uncertainty

The Bank of Japan has cut its economic growth forecasts for 2025 and 2026, blaming “excessive uncertainties” on trade, a move that raises doubts about future interest rate hikes. At the start of the year, many economists expected the Bank of Japan to make small rate hikes every six months. The BoJ said in Thursday’s outlook statement that underlying consumer price inflation is likely to remain sluggish due to an expected slowdown in the economy. Noting that real interest rates are still at low levels, the BoJ said it will continue to raise the policy rate if its outlook for economic activity and prices is realized. Japan’s finance minister has publicly identified the country’s more than $1 trillion of US Treasury holdings as a “card” in trade talks with the Trump administration, a rare baring of teeth by America’s closest ally in Asia. Japan’s position as the largest foreign holder in the Treasury market could become even stronger as a negotiating tool if China decides to weaponries its Treasury holdings in its trade confrontation with the U.S. The rare public statement by Japan’s typically reserved and diplomatic finance minister highlighting the country’s U.S. Treasury holdings as a strategic asset reflects a newfound assertiveness among Japan’s leadership in its approach to relations with the United States.

Conclusion and disclaimer

The content on MarkShala.com is intended for educational and informational purposes only. We specialize in writing blogs on financial planning, investment strategies, economic trends, and related topics. While we strive to provide accurate and reliable information, the content should not be taken as professional financial, investment, or legal advice.

80% of Indians are NOT covered with proper Advisory for Wealth Creation, Right Insurance Protection and Financial Help!

Don’t be a part of the herd — take the first step and lead the way. Book a FREE call with MarketShala (WhatsApp – +91-8209177236 or Write at somnath@markshala.com) to learn more about the art of Right Investing, Insurance and find the best solution for you and your family.

Click Here and start your journey to invest in your first crypto currency.

Click Here and start your journey to invest in your first Stock, Index, Commodity and move ahead with your wealth creation journey.

How did you like our blog? Do share your thoughts in the comment box. Your thoughts will inspire us to bring more good and relevant content for you so that we can enhance the quality of our content and you can benefit more.

Thank you for tuning in to MarketShala’s Fin Dose — your essential source for insights into the financial markets, India and global economy, Don’t forget to share this story on your network.

Explore More on MarketShala Stay updated with insights on global events, market analysis, and investment strategies on Markshala, where we aim to make financial education accessible and actionable.Now, let’s shift gears and unwind! Treat yourself to the soothing tunes of MuziMuffin with his latest release available on Spotify, YouTube and Apple Music. Relax, recharge, and enjoy the vibe!

***********

|| ॐ नमः शिवाय ||