Hello MarketShalians, Welcome to explore today’s Global Market Pulse India Trading Insights at MarketShala. Let us take a look at what major buzz related to the economic actions and trading levels are taking place in the country and the world and what impact they are going to have.

Table of Contents

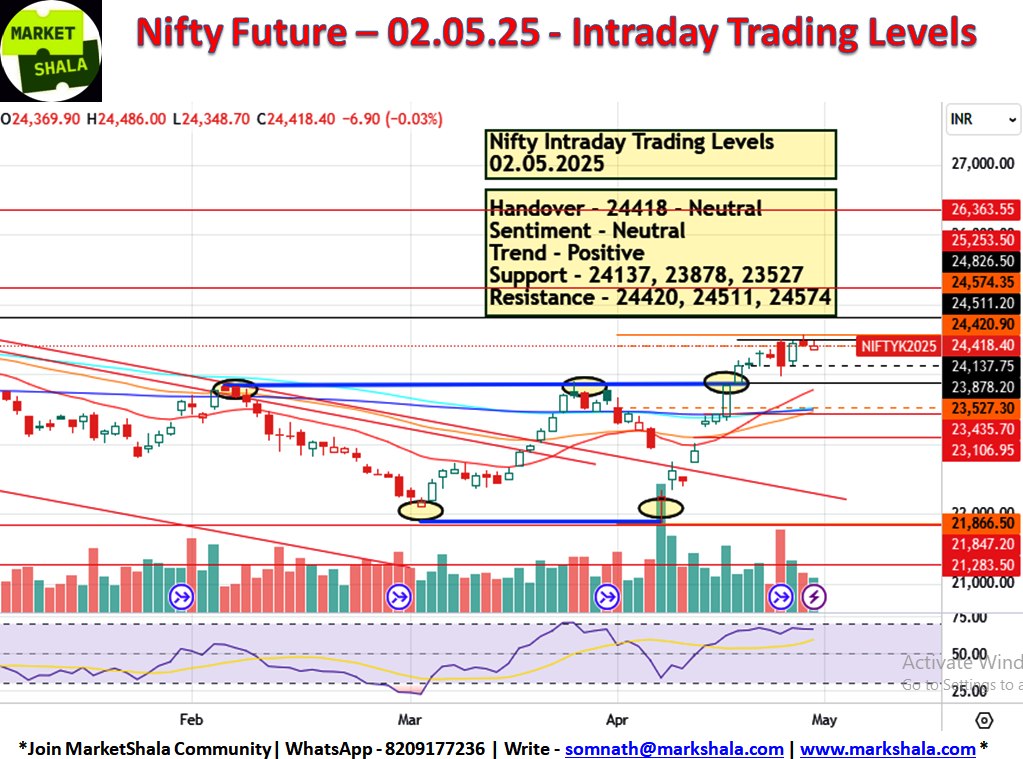

Nifty Trading Levels

New levels are created on the daily charts of Nifty Future as tomorrow April month’s High, Low, Open and Close will also be seen incorporating on the charts. Both the handover of Nifty and the sentiment are seen on the NEUTRAL side. It is possible that the markets are seen trading a little cautiously due to the cross border tensions between India and Pakistan. Due to this, a range bound trade is seen in the 6-7 trading sessions on the daily charts where Nifty is trading within a range and neither going up nor coming down. Keeping in mind tomorrow’s trade strategy, the levels that are visible on Nifty Future charts are like this.

Handover – 24418 – Neutral

Sentiment – Neutral

Trend – Positive

Support – 24137, 23878, 23527

Resistance – 24420, 24511, 24574

Bank Nifty Trading Levels

Bank Nifty price and action are looking a bit weak, showing a strong weakness in the last trading session. However, Bank Nifty is also seen trading in a range and has come to stand between its lower and upper range of last week. This is a place where both the skills and patience of the trader are going to be tested. Trading with a bias towards any one side can be risky. So waiting for the below given levels and buying near support and selling near resistance will be a good strategy until Bank Nifty does not give any one way breakout or break down.

Handover – 55241 – Weak

Sentiment – Neutral

Trend – Up & Consolidating

Support – 54712, 54582, 54423

Resistance – 55890, 56196

Stock of the day – 02.05.2025

Now let’s talk about the stock of the day for 02.05.2025. NAMINDIA’s positional trade idea is on our radar. An excellent higher trend formation is seen forming on its chart. After seeing a decline for 2-3 days after Q4 results, this stock has shown a good session on 30.04.2025 and its positioning on the chart is looking good. Its stop-loss is definitely a bit high but comparatively it has the potential to grow further with a 1:2 risk and reward ratio. Position sizing can be used to defend a large stop loss which is also known as money management. A positional trade plan can be made and executed based on yesterday’s market levels given below.

Buy at CMP/638

Stop Loss at 606

Target at 703

RRR at 1:2.03

Copper Surplus to Weigh on Prices as Gold Slips Amid Strong Dollar and Easing Safe-Haven Demand

There’s been a lot of buzz in the metals market lately, especially when it comes to copper. The International Copper Study Group (ICSG) says we might be looking at a surplus of nearly 500,000 tonnes over the next couple of years. Why? Well, production is picking up speed in several parts of the world. Countries like Congo, Mongolia, and Russia are pulling more copper out of the ground, and they’re not alone, Australia, Indonesia, and Kazakhstan are also stepping up output. All of this extra supply could drive prices lower, which might shake things up in the global commodities space.

Now, let’s talk about gold, because that’s been moving too, and not in the direction most investors would like. Gold futures have recently slipped by around 2.65%, bringing the price down to about $3,231 per troy ounce. Although gold remains up by around 20% for the year, it has dropped close to 8% since reaching its peak of $3,509.90 on April 22.

So, what’s behind the dip? A stronger U.S. dollar is part of it, but there’s also been a wave of profit-taking. A lot of investors who bought gold earlier in the year are now booking profits. Plus, with markets becoming a bit more optimistic, largely thanks to signs that President Trump’s administration is making progress on key trade deals, many traders are shifting out of safe-haven assets like gold and putting their money into riskier plays like equities.

China-U.S. Trade Tensions Slash Cargo Volumes and Trigger Shipping Disruptions

The trade tensions between China and the United States are taking a noticeable toll on global cargo movement. Container shipments from China to the U.S. have plummeted by up to 50%, and the increase in exports from Southeast Asia hasn’t been enough to fill that gap. As a result, transpacific trade volumes have seen a significant drop.

According to customs figures, Last year, the United States brought in approximately 11 million containers from China, which accounted for about 38% of its total imports. But with the introduction of fresh U.S. tariffs, industry insiders estimate that this figure has already fallen by nearly 300,000 containers.

In response to reduced demand, shipping companies are scaling back operations by cancelling scheduled trips or sending out empty ships, a practice known as “blank sailings.” This strategy mirrors the early days of the COVID-19 pandemic, as noted by the Baltic Exchange, which monitors shipping rates worldwide.

The first economic jolt has been felt in China, though the U.S. might not see the full impact immediately since many companies are still working through existing inventory that lasts a month or two. Gene Seroka, who heads the Port of Los Angeles, recently stated that they are anticipating a sharp 30.4% decline in container arrivals for the week. Additionally, 17 voyages scheduled for May have already been scrapped. When combined with the Port of Long Beach, this region forms the biggest port complex in the country making the slowdown particularly alarming. With U.S. demand for Chinese products weakening under the weight of tariffs, major shipping lines are downsizing vessels and scaling back capacity. In some cases, logistics providers are even cancelling shipments outright highlighting a deeper transformation underway in global supply chain patterns.

Conclusion and disclaimer

The content on MarkShala.com is intended for educational and informational purposes only. We specialize in writing blogs on financial planning, investment strategies, economic trends, and related topics. While we strive to provide accurate and reliable information, the content should not be taken as professional financial, investment, or legal advice.

80% of Indians are NOT covered with proper Advisory for Wealth Creation, Right Insurance Protection and Financial Help!

Don’t be a part of the herd — take the first step and lead the way. Book a FREE call with MarketShala (WhatsApp – +91-8209177236 or Write at somnath@markshala.com) to learn more about the art of Right Investing, Insurance and find the best solution for you and your family.

Click Here and start your journey to invest in your first crypto currency.

Click Here and start your journey to invest in your first Stock, Index, Commodity and move ahead with your wealth creation journey.

How did you like our blog? Do share your thoughts in the comment box. Your thoughts will inspire us to bring more good and relevant content for you so that we can enhance the quality of our content and you can benefit more.

Thank you for tuning in to MarketShala’s Fin Dose — your essential source for insights into the financial markets, India and global economy, Don’t forget to share this story on your network.

Explore More on MarketShala Stay updated with insights on global events, market analysis, and investment strategies on Markshala, where we aim to make financial education accessible and actionable.Now, let’s shift gears and unwind! Treat yourself to the soothing tunes of MuziMuffin with his latest release available on Spotify, YouTube and Apple Music. Relax, recharge, and enjoy the vibe!

***********

|| ॐ नमः शिवाय ||