Hello MarketShalians, Welcome to explore today’s Global Market Pulse & India Trading Insights at MarketShala. Let us take a look at what major buzz related to the economic actions and trading levels are taking place in the country and the world and what impact they are going to have.

Table of Contents

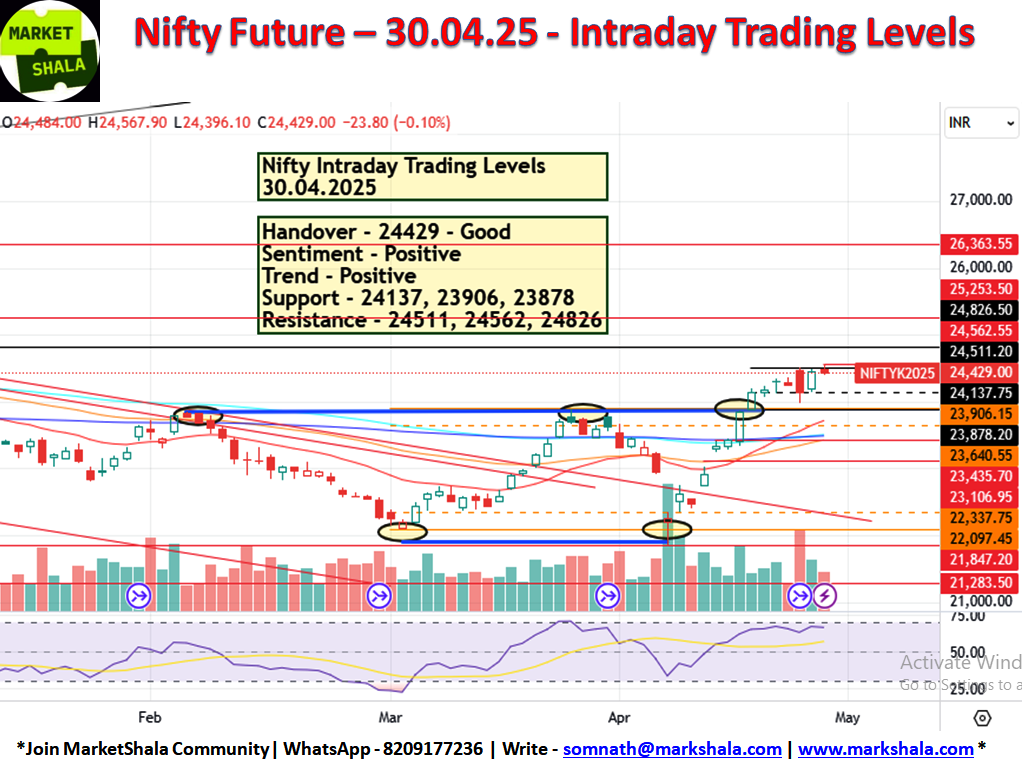

Nifty Trading Levels

The daily chart of Nifty Future is visible in front of you. Although a fall of -.10 percent is seen today in the current future levels of Nifty, despite this we are keeping the handover in the GOOD category because if you look at the overall price and action of the whole day, new higher high and higher low have been formed on the charts. If no bad news comes overnight, then the sentiment appears to be positive. The trend is formed on the bullish side. The support and resistance levels of Nifty Future for tomorrow will be like this.

Handover – 24429

Support – 24137, 23906, 23878

Resistance – 24511, 24562, 24826

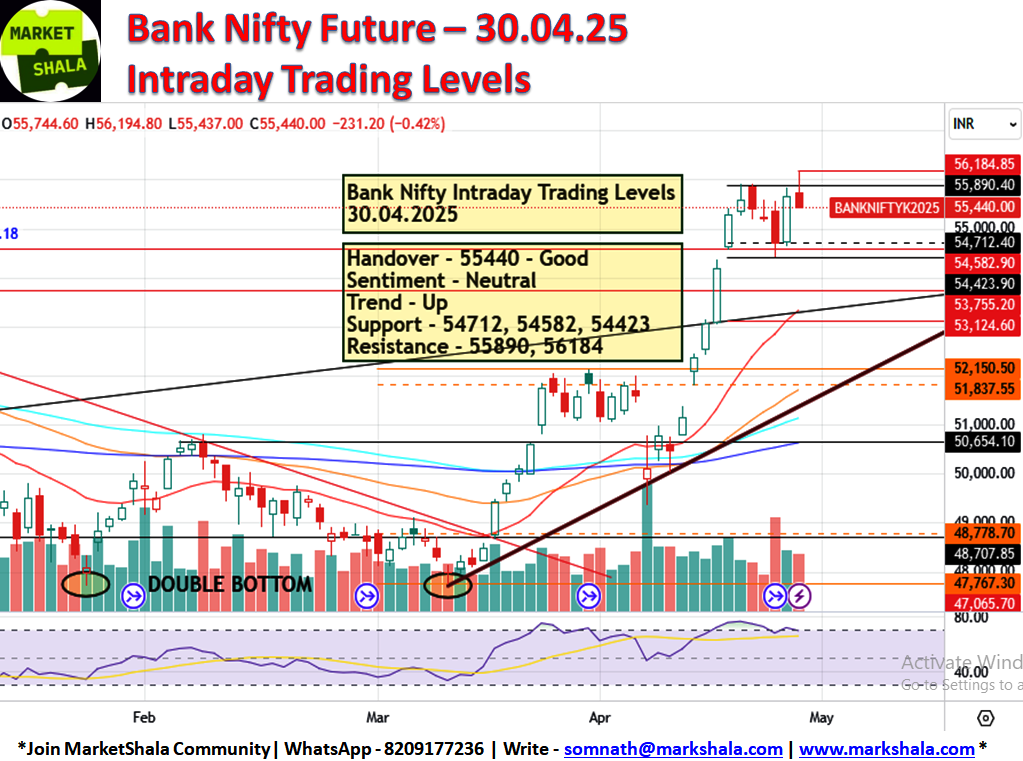

Bank Nifty Trading Levels

Bank Nifty witnessed a fall of -.42 percent today. Although today’s candle created an all time high for Bank Nifty, despite this the manner in which Bank Nifty closed at its lowest level is going to hurt the positive sentiments a bit. This is why we have kept the sentiment on the NEUTRAL side today. The handover is good due to higher high and higher low formation and the trend is still upwards. Bank Nifty traders should keep the below given levels in mind for tomorrow.

Handover – 55440

Support – 54712, 54582, 54423

Resistance – 55890, 56184

Stock of the day – 30.04.2025

We have kept HAVELLS stock on our radar for tomorrow. If we get it at current market price tomorrow, we will look at taking a buying position in it. Since Risk Reward Ratio is slightly higher than 1:2, if there is an opportunity slightly above or below it, we can enter it with a minimum RRR of 1:2. This trade will be a spot level trade and its important levels will be as follows.

Buy at CMP/1622

Stop Loss at 1582

Target Price at 1712

RRR at 1:2.21

India, Japan, and South Korea Lead Trade Talks with U.S. to Avoid Tariff Hikes Before July Deadline

Asian nations like South Korea, Japan, and India are taking proactive steps in trade negotiations with the Trump administration, especially as they grapple with the threat of increased U.S. tariffs on their exports. These countries are expected to finalize a limited, temporary deal aimed at avoiding harsh U.S. trade penalties before the 90 day window closes in early July. Currently, the U.S. is engaged in discussions with 18 major trading partners. According to Treasury Secretary Scott Bessant, talks, particularly those involving Asian economies, are showing promising progress.

Apple Moves iPhone Manufacturing to India as U.S.-China Trade Tensions Rise; PepsiCo Signals Unusual Profit Warning Due to Tariff Pressures

China has expressed strong confidence in meeting its 5% economic growth target for the year, despite ongoing trade tensions with the United States. Meanwhile, Apple is accelerating its shift away from China by planning to manufacture all U.S. bound iPhones in India. In 2024, around 28% of Apple’s global iPhone shipments amounting to 232.1 million units were destined for the U.S. To fully transition production for the U.S. market, Apple will need to significantly expand its manufacturing capacity in India.

In other developments, PepsiCo has revised its full-year profit outlook, now expecting no growth marking a notable shift in its financial trajectory. The company also sources key concentrate ingredients from Ireland, potentially exposing it to additional tariff costs. Historically, PepsiCo has been known for three core strengths: launching innovative beverages and snacks, aggressively managing costs to boost margins, and maintaining steady guidance. However, the current tariff uncertainty has triggered the company’s first guidance warning in decades.

Conclusion and disclaimer

The content on MarkShala.com is intended for educational and informational purposes only. We specialize in writing blogs on financial planning, investment strategies, economic trends, and related topics. While we strive to provide accurate and reliable information, the content should not be taken as professional financial, investment, or legal advice.

80% of Indians are NOT covered with proper Advisory for Wealth Creation, Right Insurance Protection and Financial Help!

Don’t be a part of the herd — take the first step and lead the way. Book a FREE call with MarketShala (WhatsApp – +91-8209177236 or Write at somnath@markshala.com) to learn more about the art of Right Investing, Insurance and find the best solution for you and your family.

Click Here and start your journey to invest in your first crypto currency.

Click Here and start your journey to invest in your first Stock, Index, Commodity and move ahead with your wealth creation journey.

How did you like our blog? Do share your thoughts in the comment box. Your thoughts will inspire us to bring more good and relevant content for you so that we can enhance the quality of our content and you can benefit more.

Thank you for tuning in to MarketShala’s Fin Dose — your essential source for insights into the financial markets, India and global economy, Don’t forget to share this story on your network.

Explore More on MarketShala Stay updated with insights on global events, market analysis, and investment strategies on Markshala, where we aim to make financial education accessible and actionable.Now, let’s shift gears and unwind! Treat yourself to the soothing tunes of MuziMuffin with his latest release available on Spotify, YouTube and Apple Music. Relax, recharge, and enjoy the vibe!

***********

|| ॐ नमः शिवाय ||