Hello MarketShalians, Welcome to the Weekly Stock Market Wrap at MarketShala. This week it is not possible to start without mentioning the Indian markets, we got to see a wonderful end to a wonderful week. It seems that among the several global issues, world markets were showing a sluggish atmosphere on one side but the Indian markets had nothing to do with them and the Nifty50 index closed after breaking out of its long term resistance bearish channel and registering a growth of more than 4 percent. So is this the end of the bearish trend that started from 27.09.2024? The answer will be the same as every time that price and action is a game of probability, so I feel that the period of decline is over now, and we should witness a bullish atmosphere in Indian markets going forward.

Talking about world markets, the Fed’s commentary on 19th March indicated the possibility of stagflation.The U.S. Fed has kept interest rates unchanged. The U.S. markets were running like a unbridled horse till a month ago, and the same market is seen showing underperformance since last few weeks. Meanwhile, the commentary on Accenture’s results on which the entire IT-Service sector was looking was also a bit worrying. According to Accenture, there is a possibility of a dent in the business that they are getting from the U.S. and its impact will be seen on Accenture’s revenue. Accenture has held DOGE, which is running under the leadership of Elon Musk, responsible for this situation. The impact of this worrying commentary of Accenture can also be seen on Indian IT companies because the business model of Indian IT companies is almost similar to that of Accenture.

Table of Contents

Last week financial world’s glimpses

* India has seen a growth of 14.72% in advance tax collection till 16th March and this increase has reached ₹10.44 Lakh Crore, which is the first time that the figure of advance tax collection has crossed ₹10 Lakh Crore.

* US President sharing PM Modi’s podcast on his social media platform TRUTH should be a relief for PM’s followers who are under fire after US President didn’t come to receive him at his office entrance like he does for other political leaders.

* “Ballet between dragon and elephant” China praises PM Modi’s remarks on bilateral ties in Fridman’s podcast. Beijing characterized the relationship between the two nations as a “graceful dance between the dragon and the elephant,” emphasizing the need for continued cooperation to ensure mutual prosperity.

* RBI has injected liquidity of INR 15.5 lakh crore into the banking system in the last two months.

US Stock Market and Dowjones Trade Probabilities

Dowjones saw a gain of 1.20 percent this week. Weakness is still visible on the charts. One strong point that can be seen in the price and action this week is that the Dowjones did not break the level at which it opened, therefore we have kept the weekly handover in the Good category. Sentiments have been kept Neutral as Dowjones has closed with gains but a gain is required to show strength is not yet visible on the charts.

Next week the strategy to trade Dowjones should be on both sides, whenever the opportunity arises, look for opportunities to trade Dowjones on both sides near the levels given below.

Respective Resistance and Support Levels are as follows:

Support – 41565, 41450, 40071

Resistance – 42291, 43018, 44433

Sentiment – Neutral

Trend – Weak

Trade Bias – Both Side (Conditional)

India Stock Market and Trade Probabilities

Nifty Outlook and Trade Probability

A big MARUBOZU candle appeared in the Nifty50 index and this week Nifty closed with a beautiful gain of 4.17 percent. This week Nifty is showing a breakout in the channel of the downtrend that has been going on for the last 6 months. The seriousness of this breakout increases further as it has come at a time when there is a soft atmosphere in the worldwide markets. This price and action is showing relative strength in Nifty.

The strategy for trading Nifty futures next week should be kept on the long side only. If on any day the daily close is below 22931 then a strategy of changing the trading bias to BOTH SIDE should be adopted. Otherwise one should look to trade Nifty next week with a buy on dip strategy near the given levels.

Respective Resistance and Support Levels are as follows:

Support – 22931, 22657, 22516, 22280

Resistance – 23438, 23584, 23853, 24826

Sentiment – Positive

Trend – Neutral

Trade Bias – Long Side (Conditional)

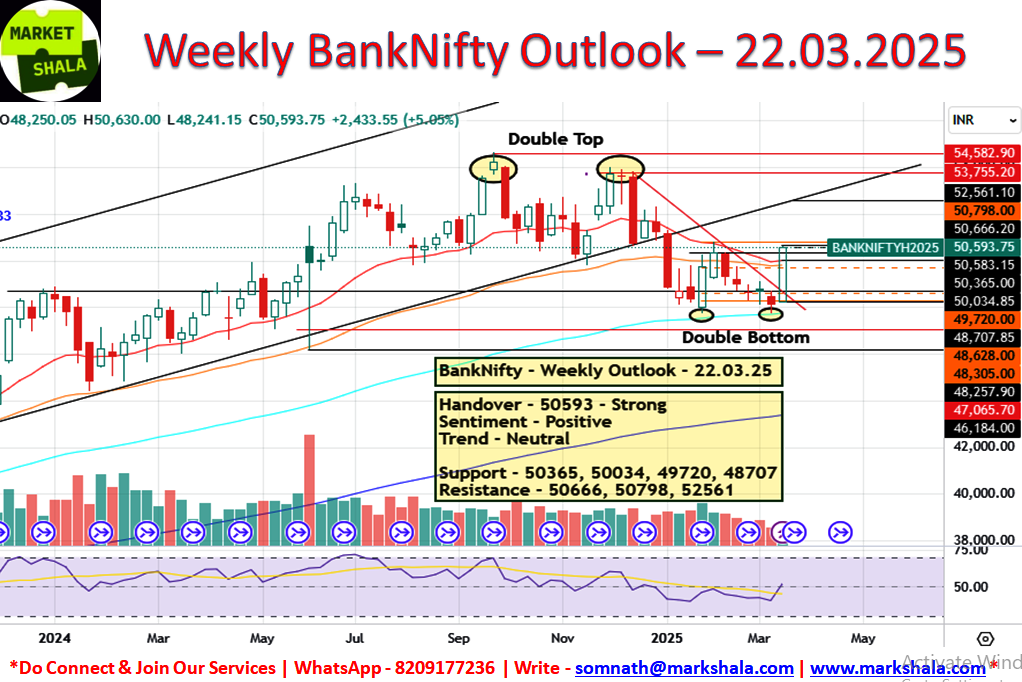

Bank Nifty Outlook and Trade Probability

Take a look at the weekly candle of Bank Nifty and you will get to know how Bank Nifty dominated the Indian markets this week. Bank Nifty covered the 8 weeks range in a single week candle and gave a breakout. A double bottom formation was created on the daily chart and justifying it, Bank Nifty showed tremendous growth this week and registered a gain of 5.05 percent.

Considering the kind of momentum created in Bank Nifty this week, it would not be wise to trade Bank Nifty on the short side next week. The trading strategy for next week in Bank Nifty should be buying on dips. Whenever there is an opportunity to trade Bank Nifty on the long side near the levels given below, one should look for trade in the next week.

Respective Resistance and Support Levels are as follows:

Support – 50365, 50034, 49720, 48707

Resistance – 50666, 50798, 52561

Sentiment – Positive

Trend – Neutral

Trade Bias – Long Side (Conditional)

Stock of the week (Long/Short)

Long Side Trade

This week AMBUJACEM is coming in our setup where we will initiate the LONG side trade. Levels and Chart image is from the cash levels and it needs to be converted into the future levels if the position is being made in FnO. If it is not available in FnO then trade will be considered in the spot levels only.

Buy at the CMP / 514.00, Stop Loss at 497.00, Target at 550.00 with a Risk Reward Ratio of 1:2.04

Short Side Trade

This week we haven’t got any Short Side Stock Trade idea into our setup and as we always say when your setup is not giving you trade better you stay away from taking trade. Because not taking trade is also equivalent to take trade in the trading business.

Alternative Investments

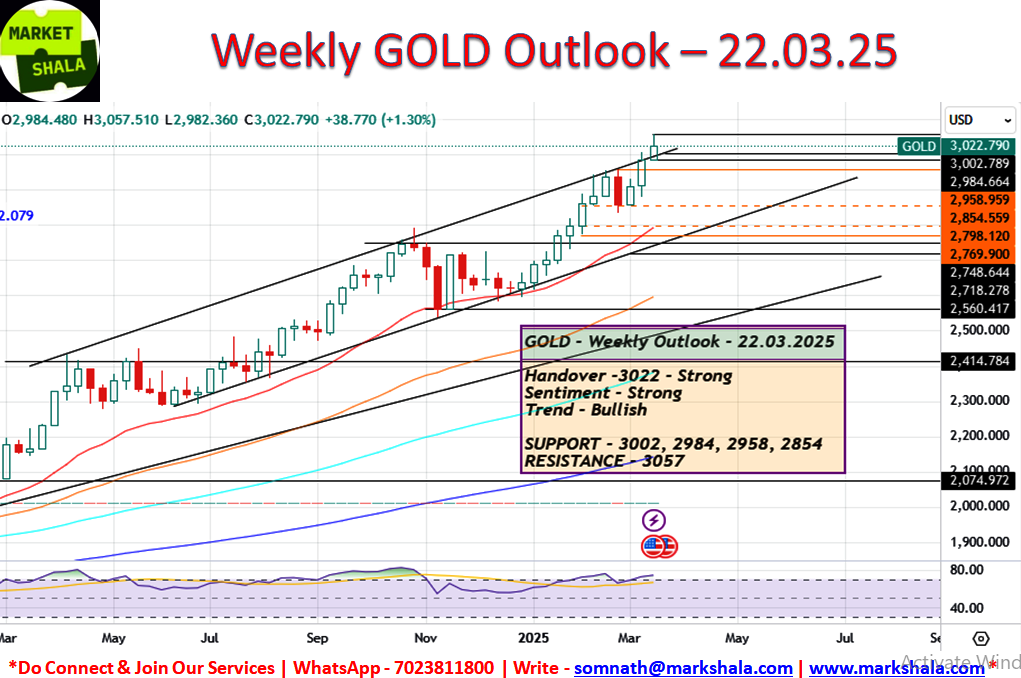

Gold Outlook and Trade Probability

Gold as per expectations continued its bullish run this week as well and created new highs for itself. Gold’s lifetime high is now at such a level that only a little effort can be made to stop it, no one else is showing the courage to put a stop to Gold’s rise. Gold gave a weekly close with a gain of 1.30 percent this week and now once again it is in its blue sky zone where only support levels are visible to you, no strong sign of resistance is visible.

The strategy to trade Gold next week should be on the long side only. Whenever there is an opportunity near the below mentioned levels, it should be traded with the strategy of buy on dips.

Respective Resistance and Support Levels are as follows:

Support – $3002, $2984, $2958, $2854

Resistance – $3057

Sentiment – Strong

Trend – Bullish

Trade Bias – Long Side (Conditional)

Silver Outlook and Trade Probability

Silver contrary to expectations registered a fall of -2.41 percent this week. If we look for the reason behind this then what is visible on the charts is that from its recent highs, where Silver started falling by forming a bearish formation evening star, it is facing a strong resistance there and this week it witnessed a fall from near $33.79. There is also a positive indication in the weekly price and action of Silver; despite the fall this week, it has formed higher high and higher low candlestick which shows that Silver has not lost strength yet and its bullish trend is intact. This week’s hand over we have kept in the Neutral category, sentiments still appear positive to us and the trend remains intact on the bullish side.

Next week’s trading strategy should be both sides on Silver and we will continue to do so until silver’s $33.79 level is decisively breached, after which our trading bias will again turn to the long side on silver. Till then we should look for opportunities to trade silver on both sides around the below given levels.

Respective Resistance and Support Levels are as follows:

Support – $32.99, $32.64, $31.32, $31.12

Resistance – $33.37, $33.79, $34.29, $34.87

Sentiment – Positive

Trend – Bullish

Trade Bias – Both Side (Conditional)

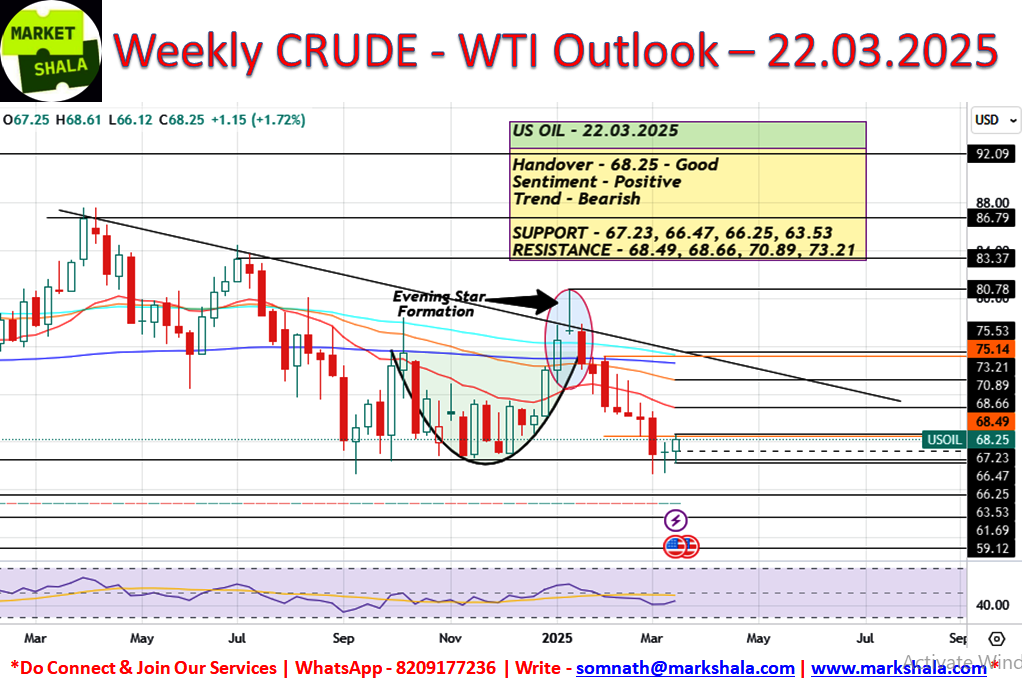

Crude Oil (WTI) Outlook and Trade Probability

Crude Oil showed an upmove near its strong support levels as expected and gave a weekly close with gains of 1.72 percent. This week’s weekly candle is bringing a hope for crude oil where we can see a higher high and a higher low formation and this formation is happening after the formation of a Dozi candle last week, it’s positive sign. Although the gains were not that big this week, still I do not see any reason for crude oil to be significantly negative at these levels. Therefore I keep this week’s handover of crude oil in the category of GOOD, I am taking the sentiments positive while the trend is still on the BEARISH side.

So now the question arises as to what should be the strategy for trading the crude oil next week. As crude is near its long term support levels, until the $66.47 level is not decisively breached at the daily closing, we will look for opportunities to trade crude on the long side only and if it is breached then the short side trading bias will again be activated. Accordingly for next week we will look for opportunities to trade crude on both sides near the below given levels.

Respective Resistance and Support Levels are as follows:

Support – $67.23, $66.47, $66.25, $63.53

Resistance – $68.49, $68.66, $70.89, $73.21

Sentiment – Positive

Trend – Bearish

Trade Bias – Both Side (Conditional)

Conclusion and disclaimer

The content on MarkShala.com is intended for educational and informational purposes only. We specialize in writing blogs on financial planning, investment strategies, economic trends, and related topics. While we strive to provide accurate and reliable information, the content should not be taken as professional financial, investment, or legal advice.

80% of Indians are NOT covered with proper Advisory for Wealth Creation, Right Insurance Protection and Financial Help!

Don’t be a part of the herd — take the first step and lead the way. Book a FREE call with MarketShala (WhatsApp – +91-8209177236 or Write at somnath@markshala.com) to learn more about the art of Right Investing, Insurance and find the best solution for you and your family.

Click Here and start your journey to invest in your first crypto currency.

Click Here and start your journey to invest in your first Stock, Index, Commodity and move ahead with your wealth creation journey.

How did you like our blog? Do share your thoughts in the comment box. Your thoughts will inspire us to bring more good and relevant content for you so that we can enhance the quality of our content and you can benefit more.

Thank you for tuning in to MarketShala’s Fin Dose — your essential source for insights into the financial markets, India and global economy, Don’t forget to share this story on your network.

Explore More on MarketShala Stay updated with insights on global events, market analysis, and investment strategies on Markshala, where we aim to make financial education accessible and actionable.Now, let’s shift gears and unwind! Treat yourself to the soothing tunes of MuziMuffin with his latest release available on Spotify, YouTube and Apple Music. Relax, recharge, and enjoy the vibe!

***********

|| ॐ नमः शिवाय ||